NO.PZ202401310100000105

问题如下:

The amount recognized on the balance sheet decreased from 31 December 20X0 to 31 December 20X1 because:

选项:

A.The sum of service cost and interest cost exceeded benefits paid.

the discount rate used in estimating the pension obligation exceeded the actual rate of return of plan assets for the year.

C.the sum of the actual return on plan assets and employer contributions exceeded the sum of service and interest cost on the benefit obligation.

解释:

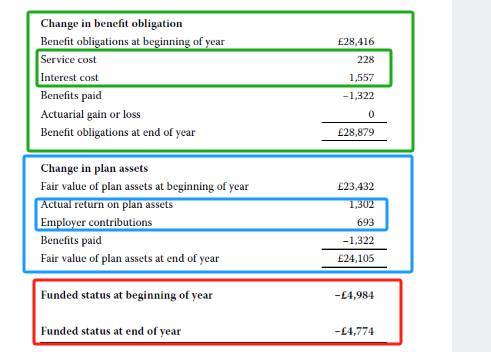

C is correct. The net pension liability recognized on Kensington’s balance sheet decreased because the fair value of plan assets increased by more than the benefit obligation.

A is incorrect. While it is true that the sum of service and interest costs exceeded benefits paid, benefits paid is deducted from both the benefit obligation and plan assets, so the relevant spread is between the sum of service and interest costs and the sum of return on plan assets and employer contributions.

B is incorrect. The discount rate used in estimating the pension obligation was 5.48% and the actual rate of return on plan assets was 1,302/23,432 = 5.56%, 8 basis points higher, not lower.

?不是说employer contribution不再financial statement?不是说service 是operating expense,怎么都和balance sheet有关了?

而且还用上了计算?