NO.PZ202401310100000102

问题如下:

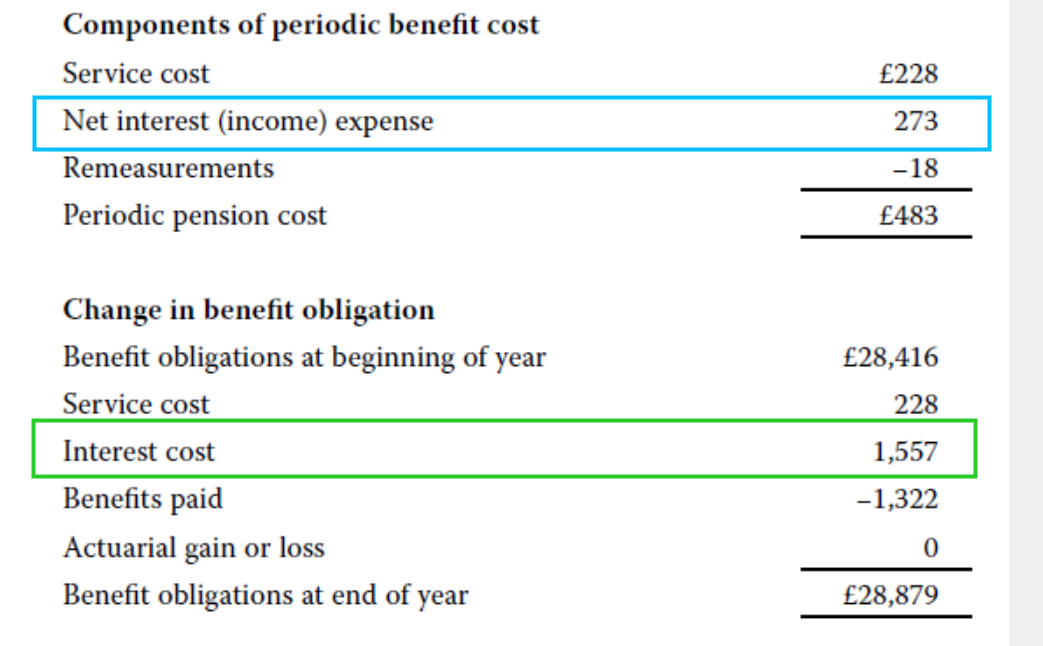

The GBP 1,284 million difference in interest expense reported on the income statement and the interest cost on the benefit obligation in 20X1 is a result of:

选项:

A.interest income on plan assets.

the actual return on plan assets.

different assumed discount rates.

解释:

A is correct. The interest expense reported on the income statement is a “net” interest expense/income amount computed as the product of the funded status and discount rate at the beginning of the year. Equivalently, it is the (discount rate x benefit obligation) – (discount rate x fair value of plan assets).

请问这个解释我没明白