NO.PZ2023090505000012

问题如下:

An issuer with limited cash flow is deciding which of its suppliers’ credit terms are least costly. Which of the following credit terms offered to the issuer by its suppliers have the lowest effective interest rate?

选项:

A.

1/10, net 50

B.

2/15, net 40

C.

3/15, net 60

解释:

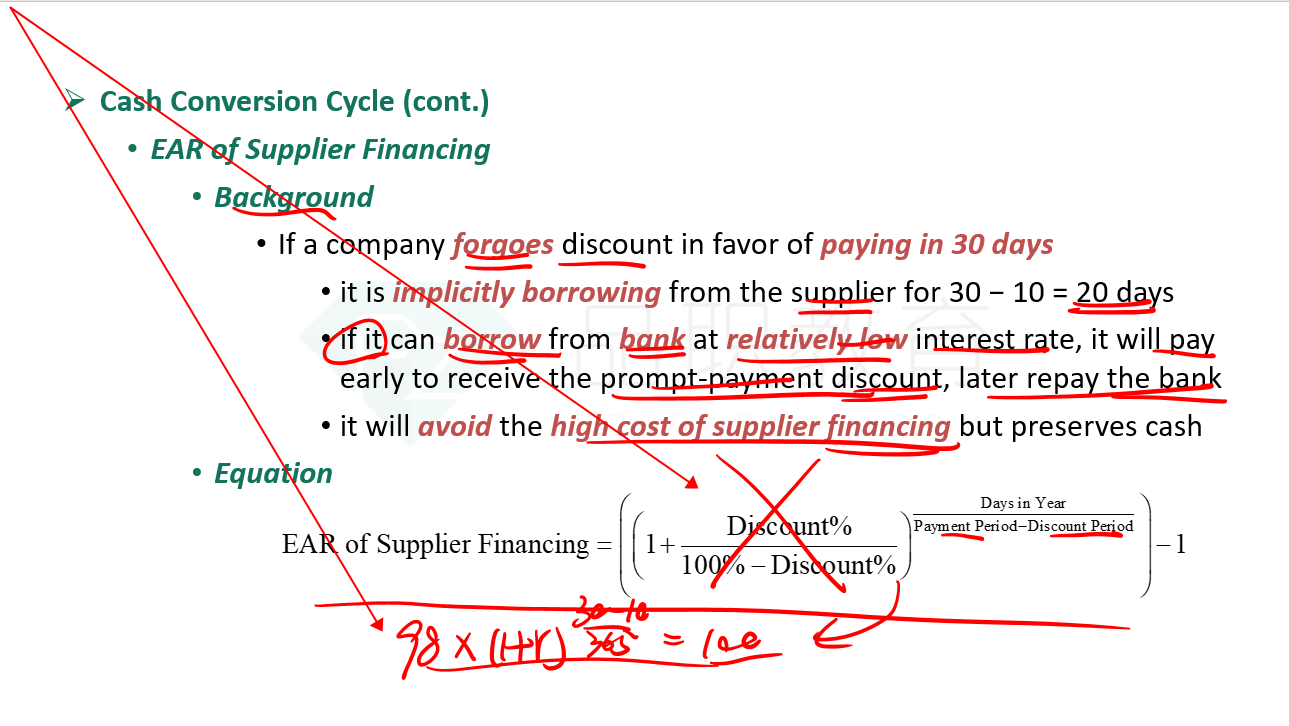

A is correct. The implicit financing cost that the issuer faces when forgoing a discount that the supplier or vendor offers is based on the amount of the forgone discount and length of the payment period beyond the discount period; 1/10, net 50 would permit the issuer to borrow for 50 − 10 = 40 days at a cost of only 1% of the purchase price (the forgone discount). The calculations for the cost of financing for each set of credit terms, expressed as an effective annual rate, are as follows:

issuer现金流受限,想要选未来能接受被付最少钱的supplier,为了付最少钱,那issuer肯定会选择提早以优惠利率支付,所以用EAR来拉伸到一年内来衡量?

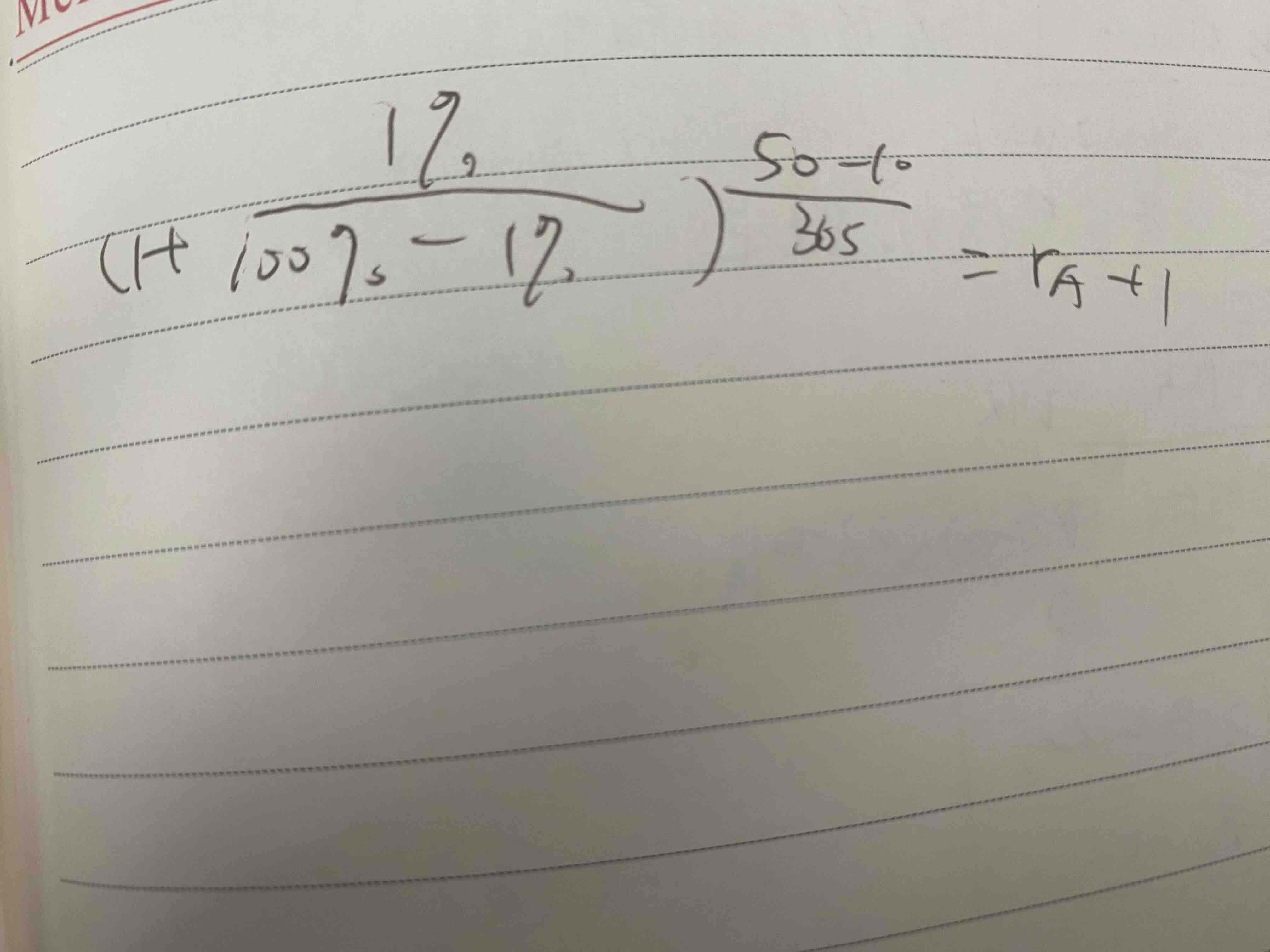

1. 请问图中等式正确吗?是我根据答案写的,但扣减优惠和优惠时间这里我不太理解,求解释,谢谢!