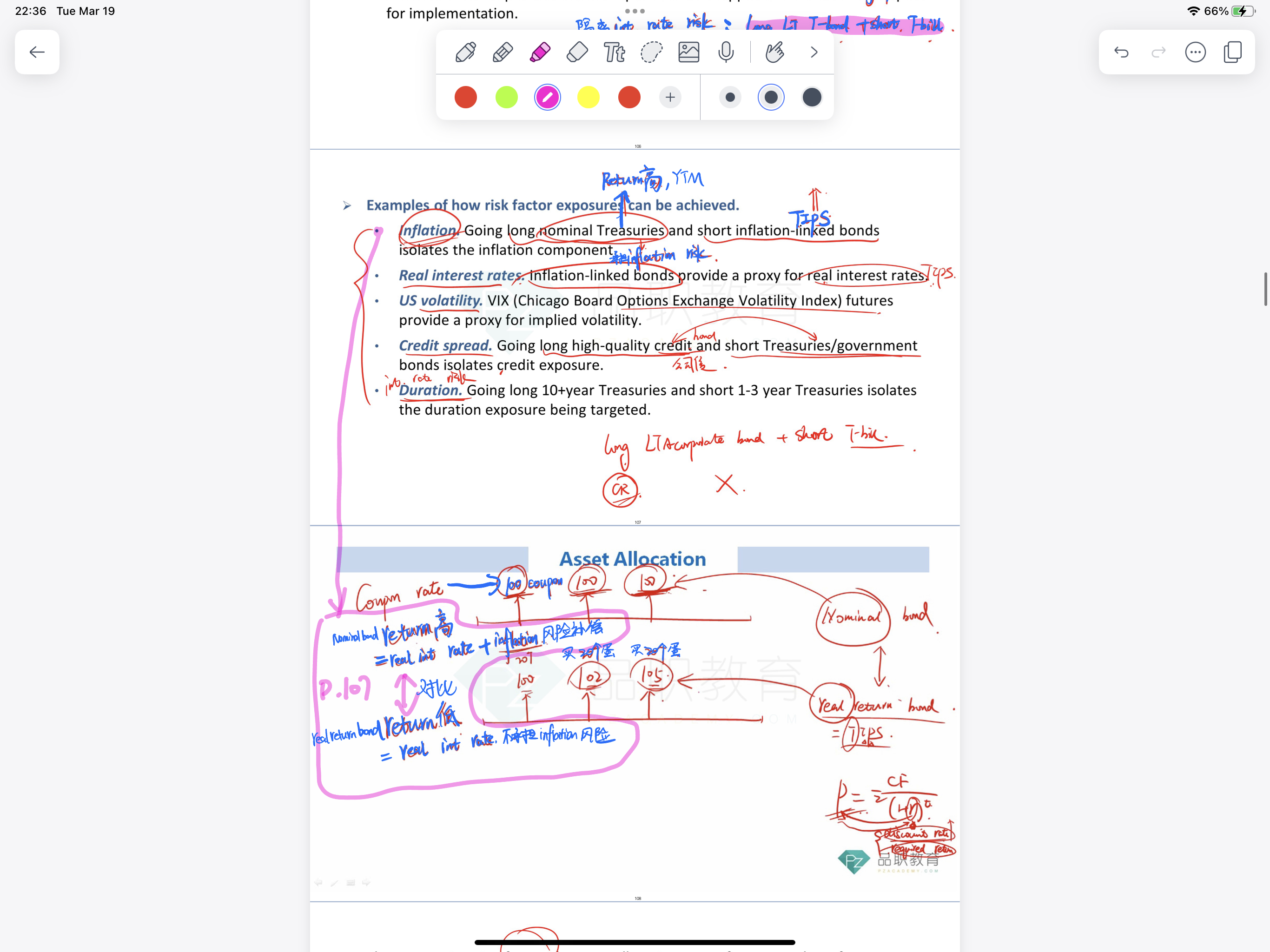

老师说tips没有通胀风险 所以return只有real interest rate。

请问real interest rate 这部分return是如何体现的呢,因为tips每一期coupon只是调整了购买力,比如说老师举的例子每期coupon都能买20个鸡蛋。那real return那部分收益是在bond price 里面体现的吗?比如说到期给的本金变多了?

下面是tips的官网介绍:

Treasury Inflation Protected Securities (TIPS)

We sell TIPS for a term of 5, 10, or 30 years.

As the name implies, TIPS are set up to protect you against inflation.

Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.

When the TIPS matures, if the principal is higher than the original amount, you get the increased amount. If the principal is equal to or lower than the original amount, you get the original amount.

TIPS pay a fixed rate of interest every six months until they mature. Because we pay interest on the adjusted principal, the amount of interest payment also varies.

You can hold a TIPS until it matures or sell it before it matures.