NO.PZ2018110601000019

问题如下:

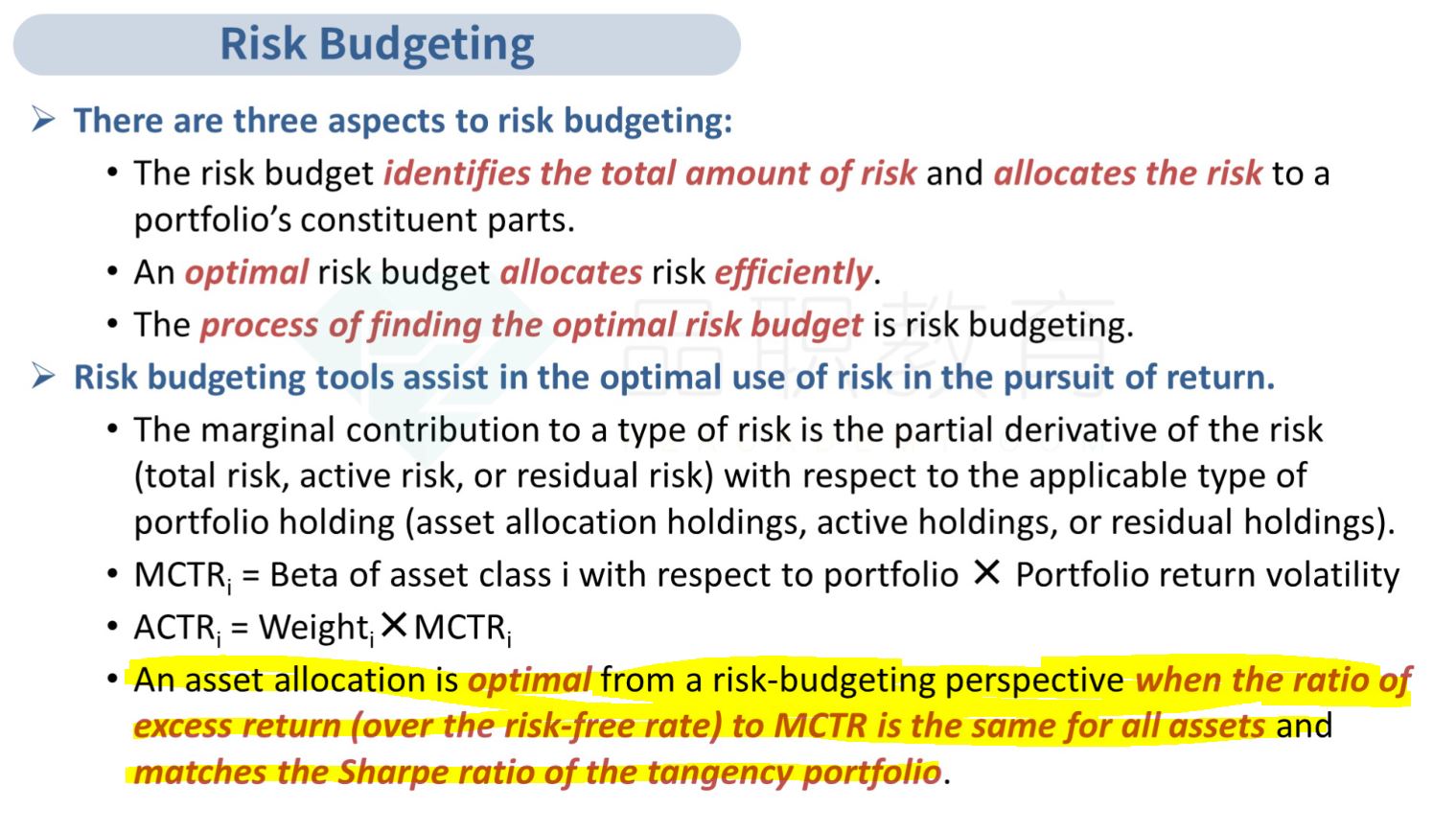

Which of the following statement regarding risk budgeting is most appropriate?

选项:

A.An optimal risk budgeting is to minimize the total risk.

B.Risk budgeting is on top-level rather than allocates the risk to a portfolio’s constituent parts.

C.An asset allocation is optimal when the ratio of excess return to marginal contribution to risk is the same for all assets.

解释:

C is correct.

考点:risk budgeting

解析:risk budgeting的目标是最大化每承担一单位风险所获得的收益,而不是最小化风险,A错。risk budgeting的过程是识别所有风险并且分配风险,B错。C是risk budgeting的结论,当每个资产类型的excess return/MCTR都相同时,资产配置是最优的。

- B选项的说法有在哪里出现过吗?

- 然后,optimal risk parity是ACTR all equal,然后optimal risk budgeting是Sharpe ratio(excess return/MCTR) all equal对吧?