NO.PZ2023090505000013

问题如下:

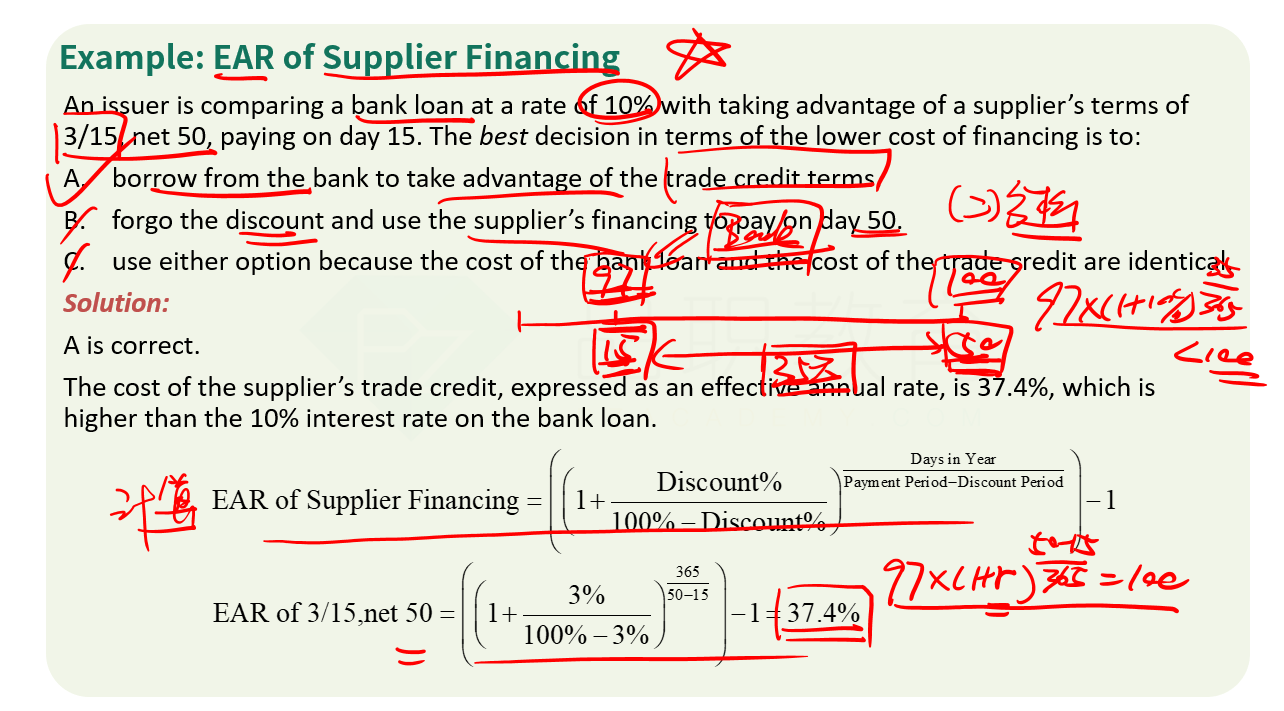

An issuer is comparing a bank loan at a rate of 15% with taking advantage of a supplier’s terms of 1/14, net 30, paying on day 14. The best decision in terms of the lower cost of financing is to:

选项:

A.

forgo the discount and use the supplier’s financing to pay on day 30.

B.

borrow from the bank to take advantage of the trade credit terms.

C.

use either option because the cost of the bank loan and the cost of the trade credit are identical.

解释:

B is correct. The cost of the supplier’s trade credit, expressed as an effective annual rate, is 25.769%, which is higher than the 15% interest rate on the bank loan.

EAR of 1/14, net 30 = 0.25769 or 25.769%

A and C are incorrect, because the bank loan rate of 15% is lower than the effective annual rate, 25.769%, on the supplier’s trade credit.

不太理解可以详细解释一下吗