NO.PZ2018062004000154

问题如下:

In IFRS,to build new production lines, company TDC borrowed a certain amount of money last year. The relevant data is listed as following:

Borrowing date:1/1/2017

Amount borrowed:$100 million

Annual interest rate:12%

Term of the loan:4 years

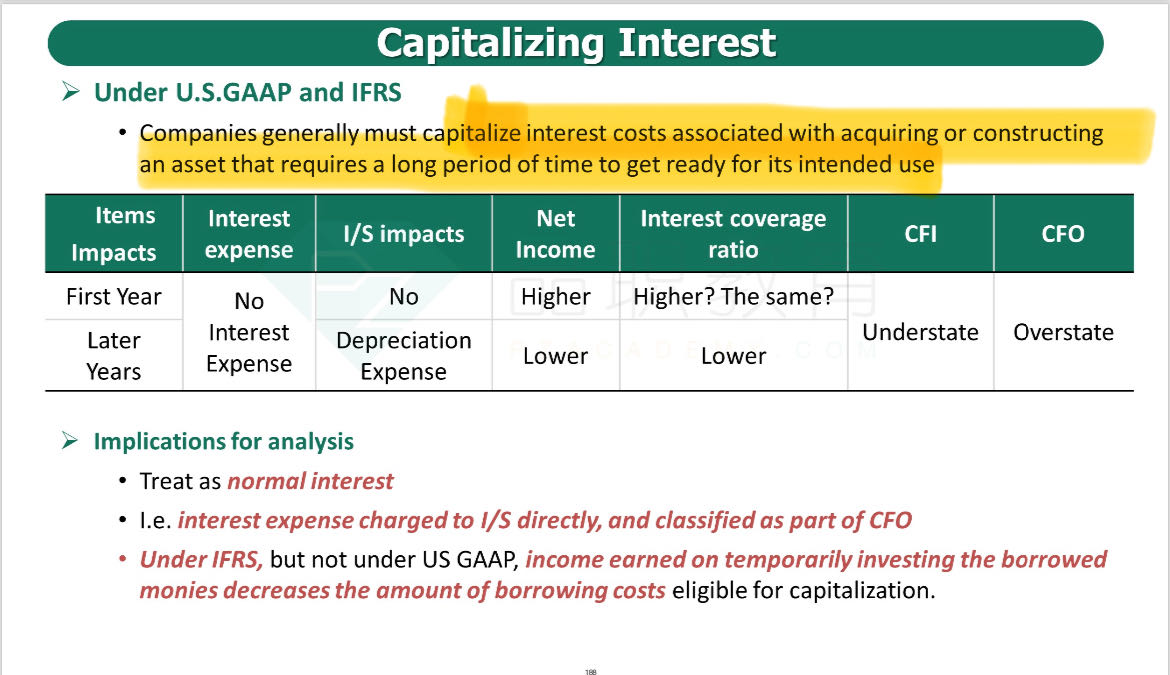

The payment method considers annual payment of interest only, principal amortization is due at the end of the loan term.The new production lines need 1 year to build, during that period, company TDC managed to earn $2 million by investing in the loan proceeds. How much is the total capitalized interest during the loan term?

选项:

A.$10 million

B.$12 million

C.$48 million

解释:

A is correct. Based on IFRS, borrowing costs should be capitalized until the tangible asset is ready for use.The interest that accrues during the construction period must be capitalized as a part of the asset's cost. Total capitalized interest=($100 million x 12% x1 year)-2 million= $10 million

想请问下,这个贷款的期限不是四年吗?四年的话,即使一年房子就盖好了,也会产生四年的利息呀?