NO.PZ2023090401000072

问题如下:

Question A fixed-income analyst is decomposing the profit and loss (P&L) of a bond over the past 6 months. The bond has a 2% coupon rate, paid semi-annually, and had exactly 2 years remaining until maturity at the start of the 6-month period. Relevant information about the bond and market rates (semi-annually compounded) is shown below:

The analyst has calculated the bond’s carry roll-down, and under the forward rate assumption made for the purpose of that calculation, the ending value of the bond is SGD 100.55. Given this information, what is the component of the bond’s P&L attributable to the change in rates over the 6-month period?

选项:

A.

SGD 0.54

B.

SGD 0.69

C.

SGD 0.74

D.

SGD 0.99

解释:

Explanation:

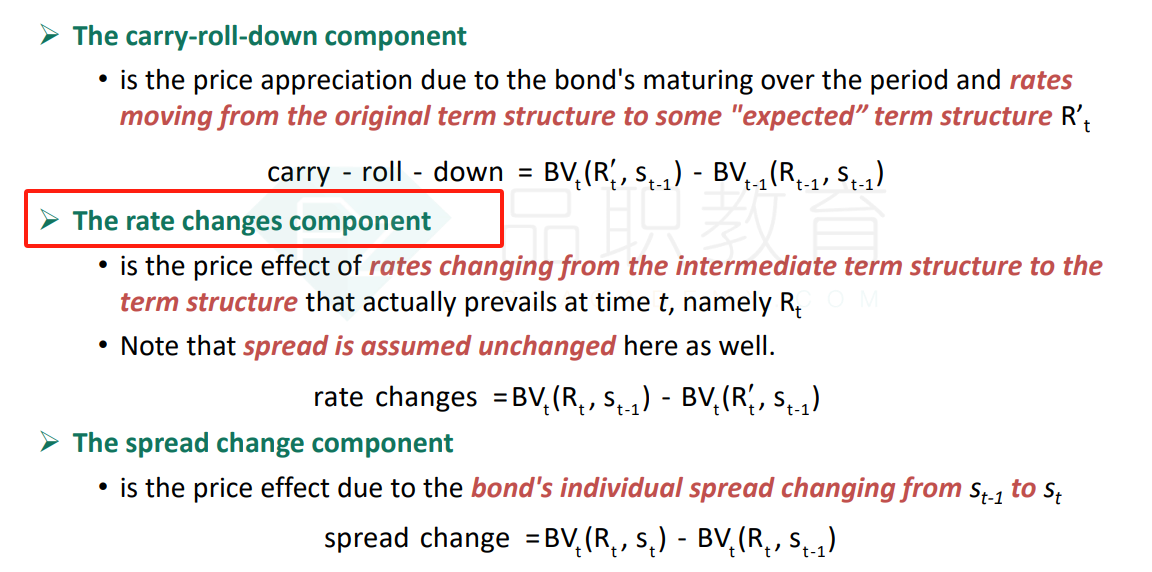

A is correct. Calculating the impact of the change in rates is the second step in decomposing the P&L of a bond, after calculating the carry roll-down. The impact of a rate change is calculated as the value of the bond at the end of the period using the ending forward rate curve (and the bond’s beginning-of-period spread), minus the end-of-period value of the bond calculated using the forward rates assumed for the purpose of determining carry roll-down (which represent some sense of “no change” in the interest rate environment). The value of the bond under the ending forward rate curve is:

Therefore, the impact of the rate change is: SGD 101.09 - SGD 100.55 = SGD = 0.54

B is incorrect. This uses the end-of-period spread of 20 bps in the above calculation rather than the beginning-of-period spread of 30 bps.

C is incorrect. This subtracts the bond’s initial price, rather than the value from the carry roll-down calculation, from the value produced in the change in rates calculation: 101.09 – 100.35 = 0.74. D is incorrect. This omits the spread from the above calculation of the impact of the change in rates.

Section: Valuation and Risk Models

Learning Objective: Explain the decomposition of the profit and loss (P&L) for a bond position or portfolio into separate factors including carry roll-down, rate change, and spread change effects.

Reference: Global Association of Risk Professionals. Valuation and Risk Models. New York, NY: Pearson, 2022. Chapter 11. Bond Yields and Return Calculations.

尤其是请问在计算债券价格时,为什么使用的是答案显示中所对应的远期利率呢?有点没太看得懂