NO.PZ2023090501000085

问题如下:

A junior market risk analyst is studying the mechanics of the EWMA approach for estimating volatility. The analyst observes that the approach applies various weights to a series of historical returns, and the return needed to update the EWMA calculation is the most recent day's squared return. Which of the following statements is correct?

选项:

A.

Daily returns prior to the most recent day have no influence on the current variance rate estimate in the EWMA calculation.

B.

Daily returns prior to the most recent day are reflected in the EWMA calculation by the smoothing parameter (A).

C.

Daily returns prior to the most recent day are reflected in the EWMA calculation by the most recent day's squared return.

D.

Daily returns prior to the most recent day are reflected in the EWMA calculation by the previous variance rate estimate.

解释:

Explanation

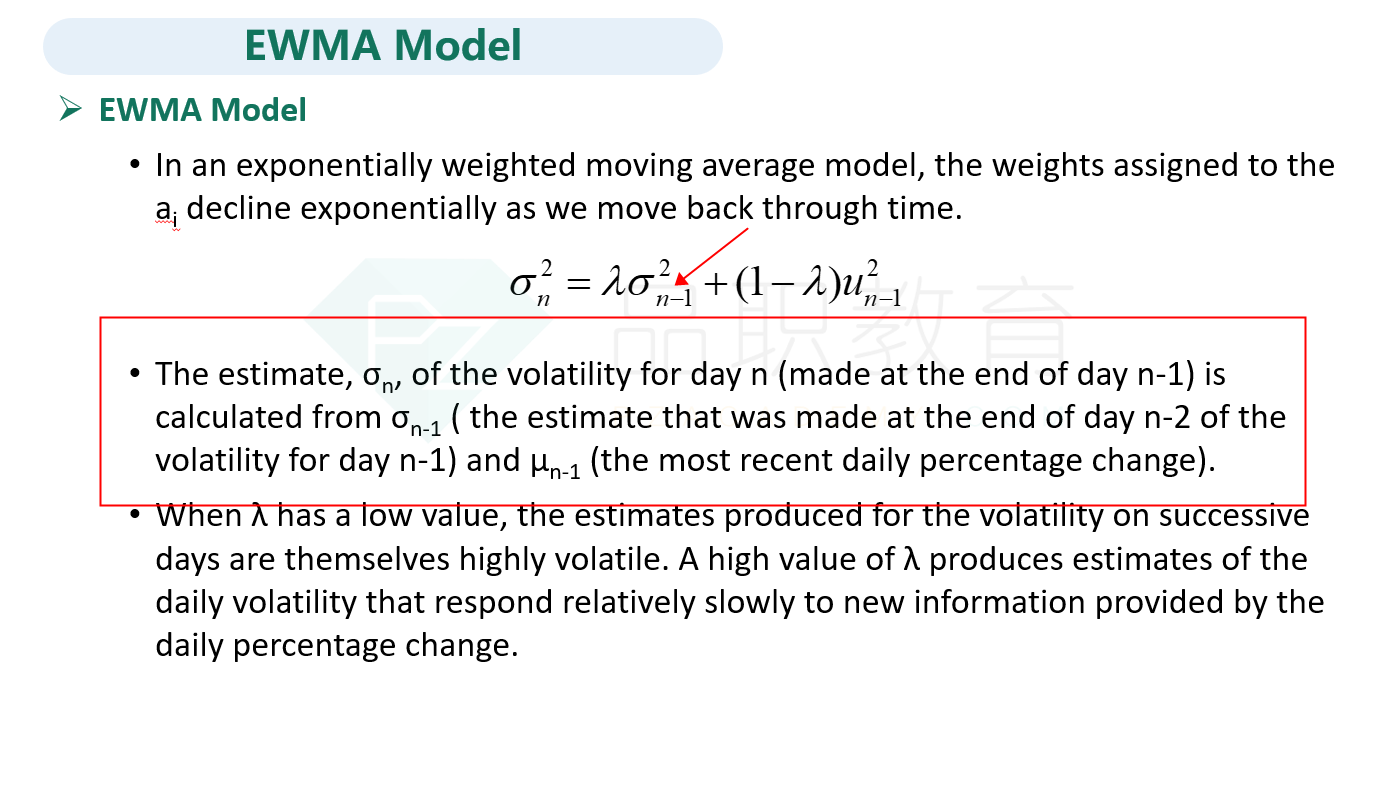

D is correct. The EWMA formula is:

Under the EWMA approach, when a new return is observed, the variance rate estimate is updated using this return. When the next new return is observed, the previously observed return is not needed, as it is reflected in the previously calculated variance rate estimate. In this way, the term 血_i in the formula contains information on all past returns.

A, B, and C are incorrect, as per the above explanation.

Section Valuation and Risk Models

Learning

Objective Apply the exponentially weighted moving average (EWMA) approach to estimate volatility, and describe alternative approaches to weighting historical return data.

Reference Global Association of Risk Professionals. Valuation and Risk Models. New York, NY: Pearson, 2022. Chapter 3. Measuring and Monitoring Volatility.

老师您好,A、B和C分别是什么意思呢?其中选项A为什么不对呢?