NO.PZ2020033001000064

问题如下:

The pricing curve of a zero-coupon bond becomes ___ when the maturity increases, assuming all other factors remain constant.

选项:

A.

less concave.

B.

more concave.

C.

less convex.

D.

more convex.

解释:

D is correct.

考点:Bond valuation

解析:

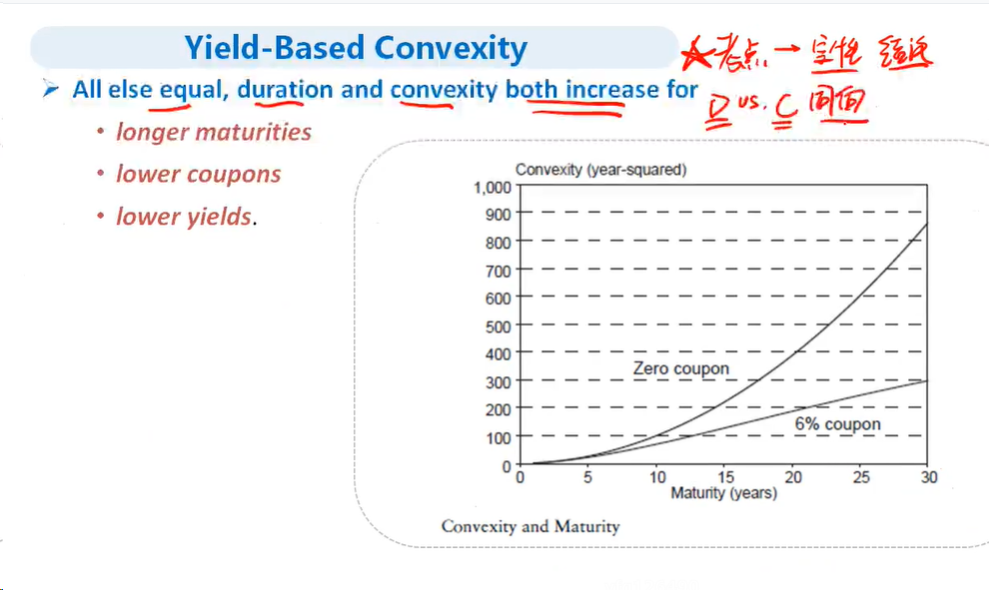

债券价格在到期日回归面值,由于零息债券一般都是折价发行,所以price curve 是凸的,且到期时间长的债券久期长,凸性随久期的增加而增加。

老师我感觉不知道原理,为啥久期越长凸性越大,原理是什么,讲义上有吗