NO.PZ2023071902000045

问题如下:

QuestionWhich group of market participants is most likely to restrict the utilization of leverage in managing their accounts?

选项:

A.Exchange-traded funds

B.Commodity trading advisers

C.Bank proprietary trading desks

解释:

Solution

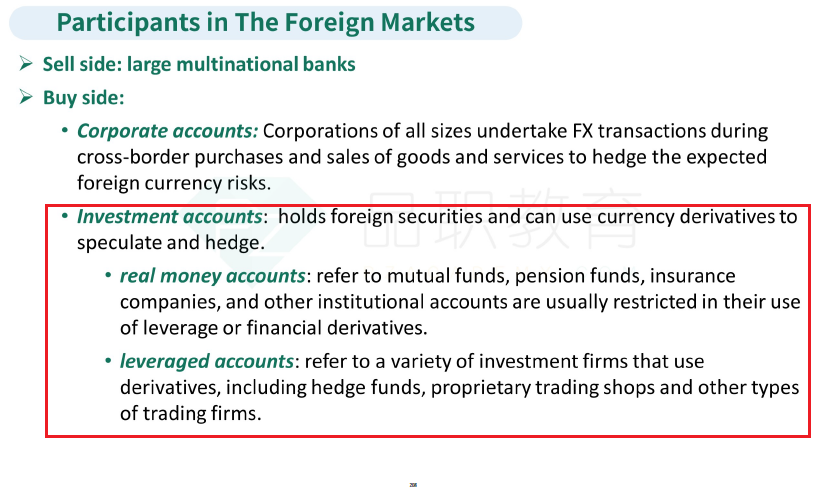

- Correct. Exchange-traded funds (ETFs) belong to the category of institutional investors known as real money accounts. These entities typically impose limitations on the use of leverage or financial derivatives in their accounts.

- Incorrect. Commodity trading advisers are part of the professional trading community and commonly utilize leverage or financial derivatives in managing their accounts.

- Incorrect. Bank proprietary trading desks are also part of the professional trading community and frequently employ leverage or financial derivatives in managing their accounts.

• describe the foreign exchange market, including its functions and participants, distinguish between nominal and real exchange rates, and calculate and interpret the percentage change in a currency relative to another currency

这个知识点对应讲义在哪里?