NO.PZ2021061002000071

问题如下:

Suppose the current price (S0)

of a non-dividend-paying stock is $50, and a put option on the stock has an

exercise price (X) of $54 with six months left to maturity. Now an investor

believes that the stock’s price in six months’ time will be either 10% higher

or 10% lower.

Which of the

following is true about constructing a perfectly hedged portfolio using put

options and their underlying stocks?

选项:

A.

Buy one put option and buy 0.9 units of the

underlying asset.

B.

Buy one put option and sell 0.9 units of

the underlying asset.

C.

Sell one put option and buy 0.9 units of the

underlying asset.

解释:

解析:

S1u = 50 * (1+10%) =

55, p1u=Max(0, 54 -55)= 0

S1d = 50 * (1-10%) =

45, p1d=Max(0, 54 -45)= 9

h = p1u - p1d / S1u - S1d = (0-9) / (55-45) = -0.9

注意计算的h是每份期权对应的标的资产的份数。Long stock与long put构成对冲组合,因此A对。

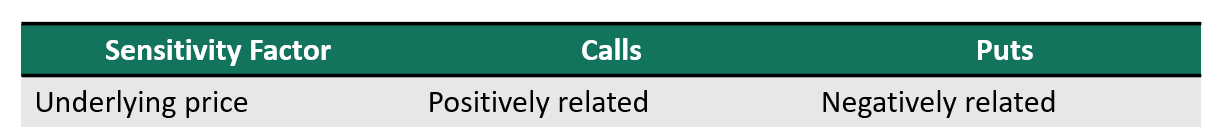

这边的正负号有什么作用,怎么看出是call 还是put