NO.PZ2018062007000082

问题如下:

If an underlying asset’s price is less than a related option’s strike price at expiration, a protective put position on that asset versus a fiduciary call position has a value that is:

选项:

A.

lower.

B.

the same.

C.

higher.

解释:

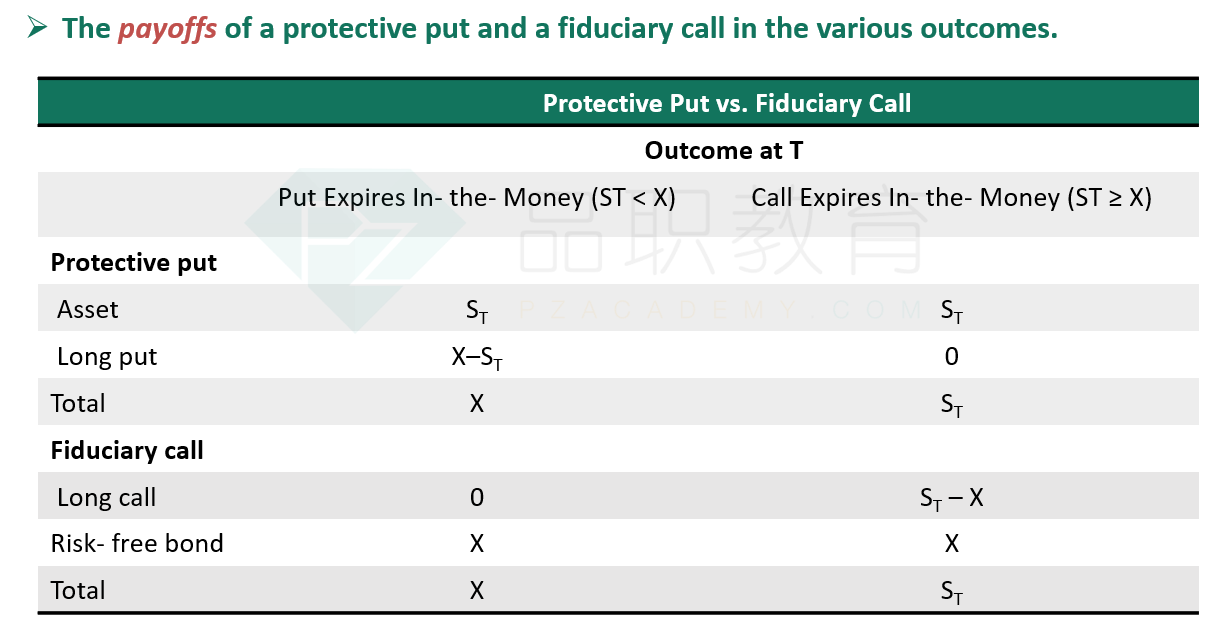

B is correct. On the one hand, buying a call option on an asset and a risk- free bond with the same maturity is known as a fiduciary call. If an underlying asset’s price is less than a related option’s strike price at expiration,the total value of the fiduciary call is X. On the other hand, holding an underlying asset, ST, and buying a put on that asset is known as a protective put. the total value of the protective put is(X-ST)+ST = X . A protective put and a fiduciary call produce the same result.

中文解析:

在T时刻,标的资产价格ST<执行价格K,在此时call option是没有价值的,为0.(因为T时刻是到期日,call的时间价值为0,而ST

所以此时C+K = 0+K=K;

另外一方面,在T时刻,put option的价值=K-ST(因为此时put的时间价值也为0,intrinsic value=K-ST),所以此时P+ST = K - ST + ST = K;

所以C+K = P + S仍然成立。

标的资产价格小于执行价格,执行起来更受损失,因此投资者会倾向于call而非put,那么call与put 为什么是一样的