NO.PZ2023081403000029

问题如下:

Q. When calculating diluted EPS, which of the following securities in the capital structure increases the weighted average number of common shares outstanding without affecting net income available to common shareholders?选项:

A.Stock options B.Convertible debt that is dilutive C.Convertible preferred stock that is dilutive解释:

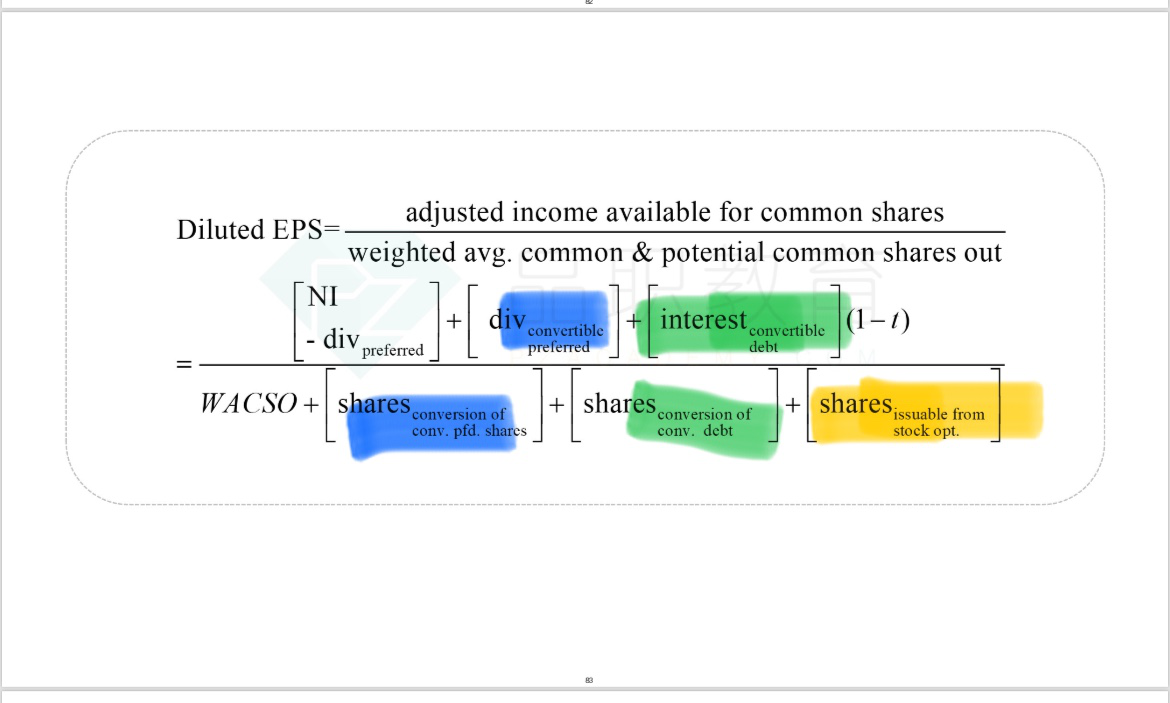

A is correct. When a company has stock options outstanding, diluted EPS is calculated as if the financial instruments had been exercised and the company had used the proceeds from the exercise to repurchase as many shares possible at the weighted average market price of common stock during the period. As a result, the conversion of stock options increases the number of common shares outstanding but has no effect on net income available to common shareholders. The conversion of convertible debt increases the net income available to common shareholders by the after-tax amount of interest expense saved. The conversion of convertible preferred shares increases the net income available to common shareholders by the amount of preferred dividends paid; the numerator becomes the net income.

老师,A的Stock option就是 =option/warrant的意思吗,就是股票期权吗?(上课老师讲的是Option,难道全称就是 Stock option?)

B好像是对的吧?讲义里面有讲 可转换债券,convertible debt,难道不是债券可以转换成股票么,然后就能稀释普通股么?

C错是因为 没有convertible preferred stock这种说法吧?

啊我理解得好含糊,求详细讲一遍吧,谢谢老师!