NO.PZ2022123001000156

问题如下:

An analyst observes the benchmark Indian NIFTY 50

stock index trading at a forward price-to-earnings ratio of 15. The index’s

expected dividend payout ratio in the next year is 50 percent, and the index’s

required return is 7.50 percent. If the analyst believes that the NIFTY 50

index dividends will grow at a constant rate of 4.50 percent in the future,

which of the following statements is correct?

选项:

A.The analyst should view the NIFTY 50 as overpriced.

The analyst should view the NIFTY 50 as underpriced.

The analyst should view the NIFTY 50 as fairly priced.

解释:

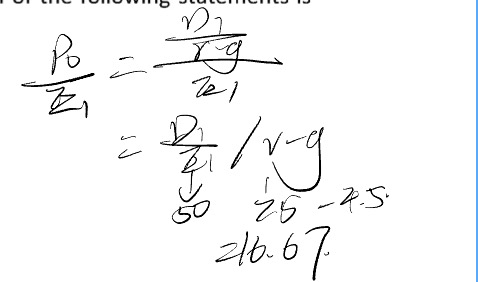

B is correct. the previous

input results in the following inequality: 15 < 0.50/(0.0750−0.045) = 16.67.

The above inequality

implies that the analyst should view the NIFTY 50 as priced too low. The

fundamental inputs into the equation imply a forward price to earnings ratio of

16.67 rather than 15. An alternative approach to answering the question would

be to solve for implied growth using the observed forward price to earnings

ratio of 15 and compare this to the analyst’s growth expectations:

15 = 0.50/(0.075− g) .

Solving

for g yields a result of 4.1667 percent. Since the analyst expects higher NIFTY

50 dividend growth of 4.50 percent, the index is viewed as underpriced.

expected dividend payout ratio 为什么可以用作D/E呢?