NO.PZ2022072501000003

问题如下:

Qualitative analysts and portfolio managersseek to integrate their qualitative investment opinion by incorporating:

选项:

A.

Negative screening.

B.

Quantitative adjustments to financial models and valuations.

C.

Qualitative measures only.

D.

None of the above.

解释:

解析:

选项B正确。投资小组在做ESG定性分析时,通常会有三个程序。他们首先会分析ESG数据来形成自己的观点,然后将这些观点和财务分析结合起来,最后会将最终观点以量化的方式来调整财务模型中的假设,完成整合工作。

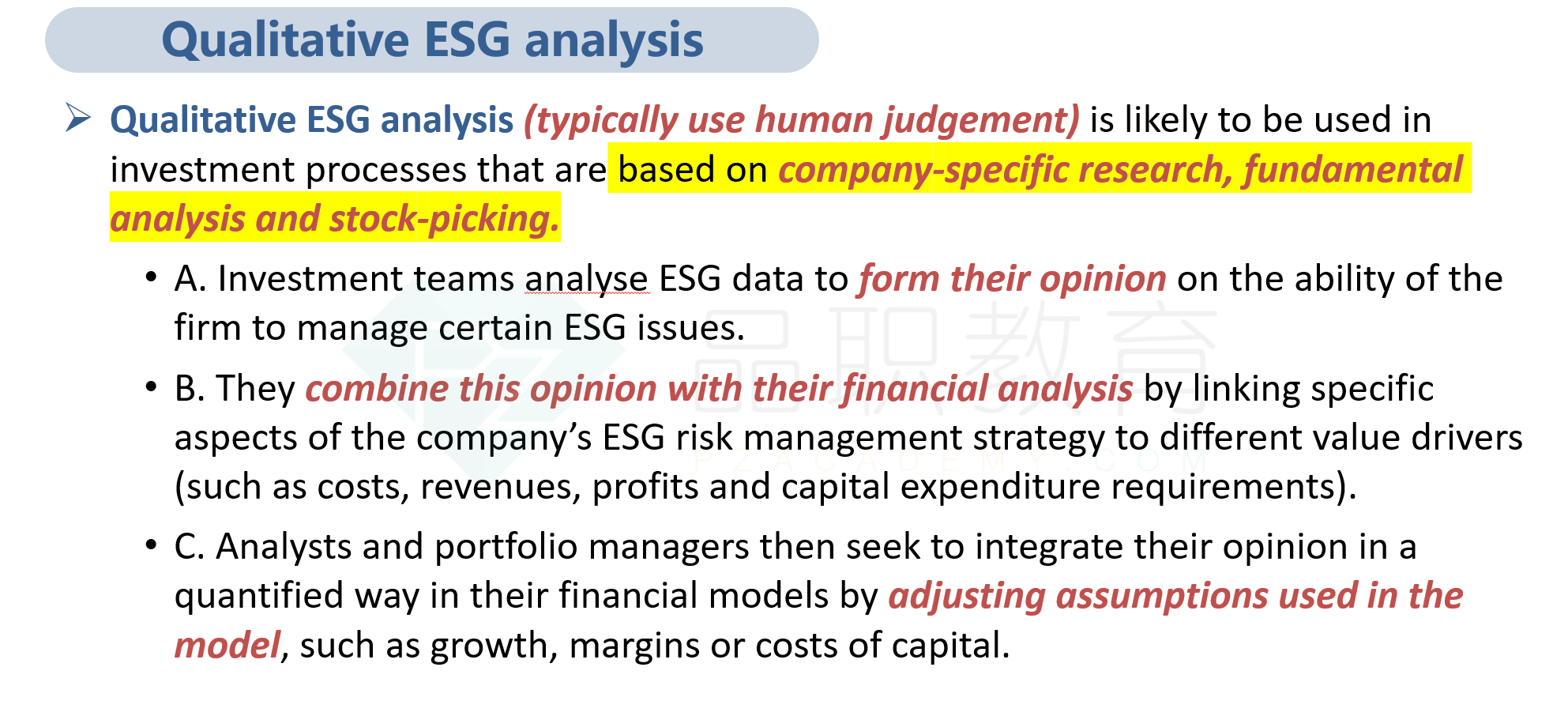

Qualitative ESG analysis typically involves threeprocedures.

First, investment teams analyse ESG data to form their opinion onthe ability of the firm to manage certain ESG issues.

Second, they combine this opinion with theirfinancial analysis by linking specific aspects of the company’s ESG risk managementstrategy to different value drivers (such as costs, revenues, profits andcapital expenditure requirements.

Third, analysts and portfolio managers thenseek to integrate their opinion in a quantified way in their financial modelsby adjusting assumptions used in the model, such as growth, margins or costs ofcapital.

老师,您好,如下图,讲义中提到的esg技术指的是什么呢?esg的整合还是分析还是估值技术?

下面提及的不同策略类型,为什么没有定性的提法呢?