NO.PZ2023090506000009

问题如下:

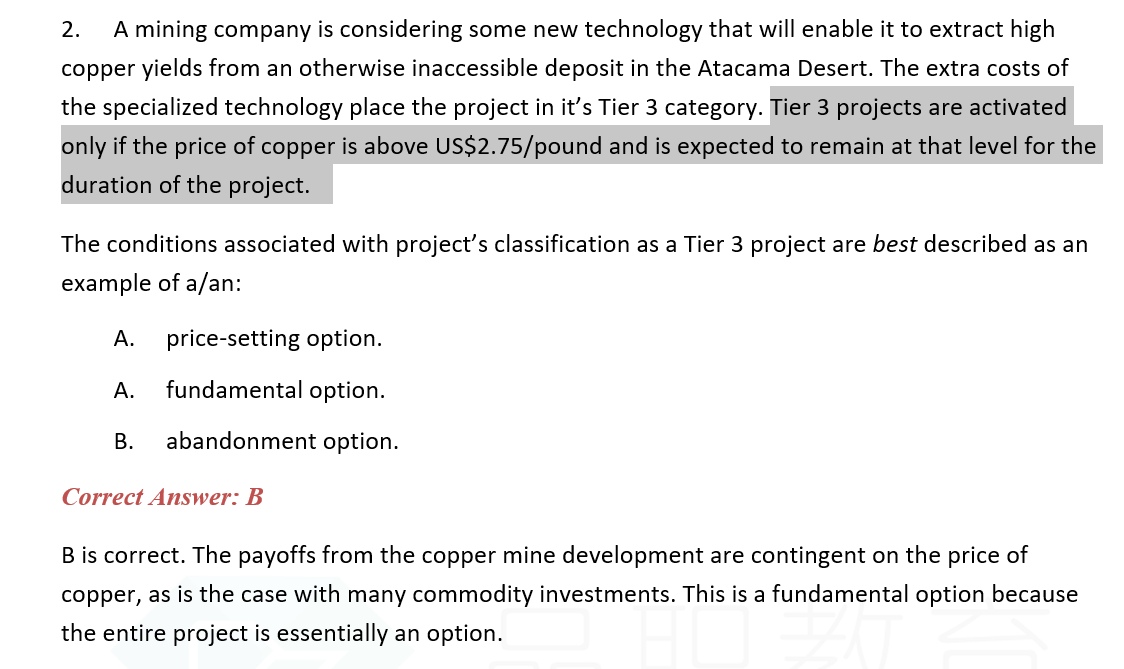

Which of the following statements about real options is true?

选项:

A.Using option pricing models estimates an option’s value with the highest accuracy.

B.Real options allow companies to abandon an investment project if its profitability is poor.

C.Real options would allow a refinery to hedge future prices of crude oil needed for production.

解释:

B is correct. An abandonment option is a type of real option, which allows a company to abandon the investment after it is undertaken.

A is incorrect because even though real options can be priced using option pricing models, the estimates require multiple unobservable inputs, such as probabilities of events and timing of their occurrence. The complexity does not necessarily improve accuracy.

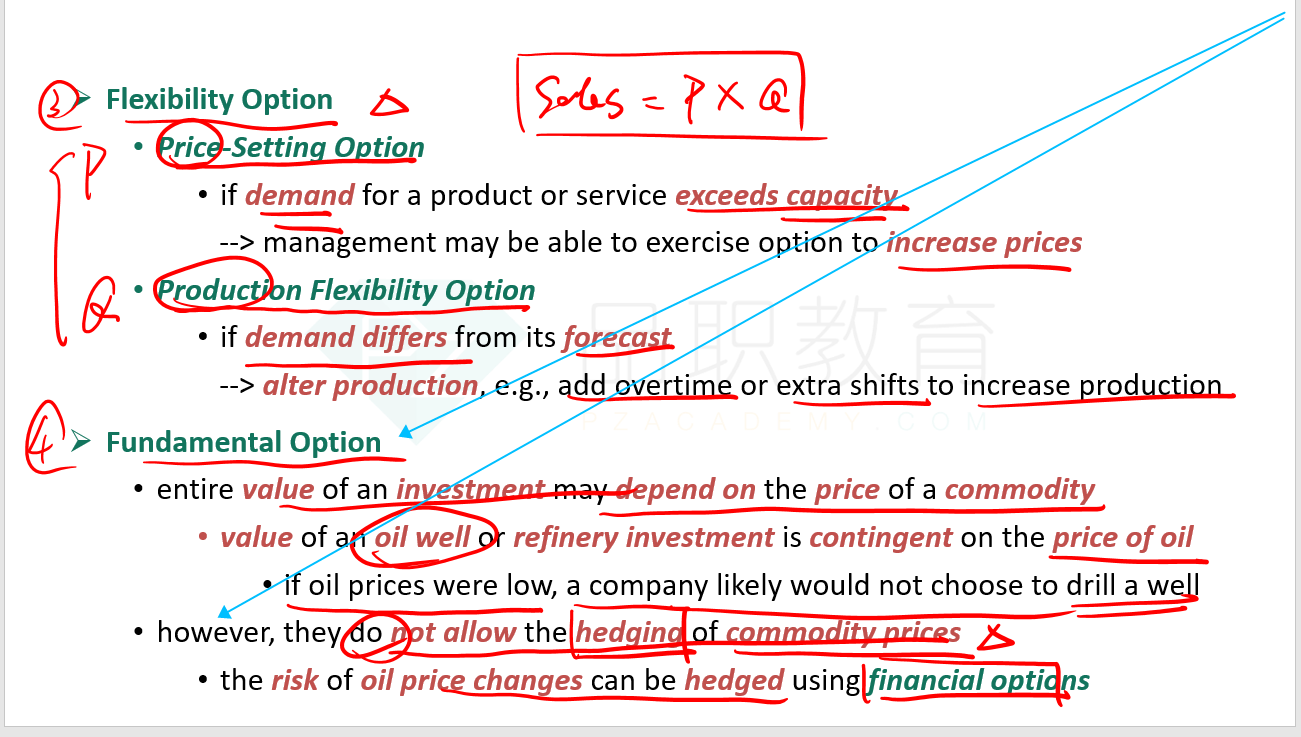

C is incorrect because real options provide companies with flexibility with regard to future decisions; however, they do not allow the hedging of commodity prices. The risk of crude oil price changes can be hedged using financial options, not real options.

以C选项为例