NO.PZ2023090507000002

问题如下:

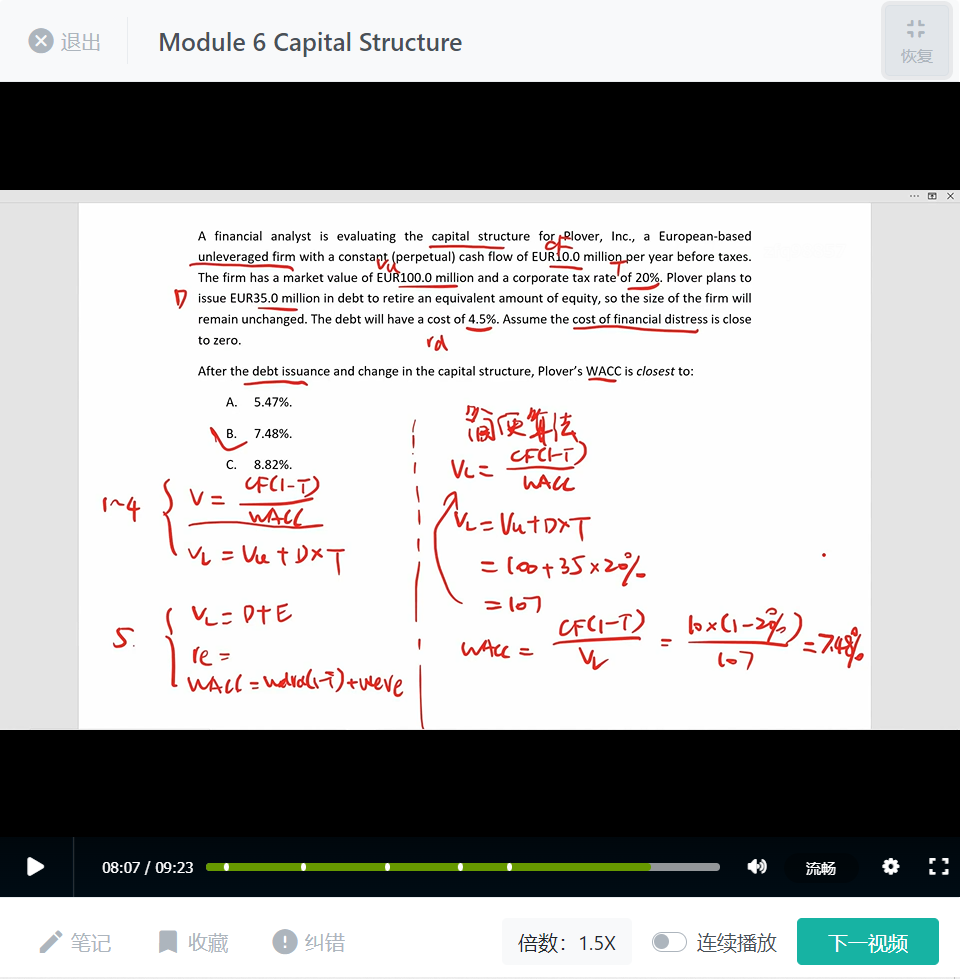

A financial analyst is evaluating the capital structure for Plover, Inc., a European-based unleveraged firm with a constant (perpetual) cash flow of EUR10.0 million per year before taxes. The firm has a market value of EUR100.0 million and a corporate tax rate of 20%. Plover plans to issue EUR35.0 million in debt to retire an equivalent amount of equity, so the size of the firm will remain unchanged. The debt will have a cost of 4.5%. Assume the cost of financial distress is close to zero.

After the debt issuance and change in the capital structure, Plover’s WACC is closest to:

选项:

A.

5.47%.

B.

7.48%.

C.

8.82%.

解释:

B is correct. The calculations to determine the WACC are as follows:

The after-tax cash flows for the company are EUR10.0 million (1 – 0.20) = EUR8.0 million. Since the cash flows are assumed to be perpetual, WACC for the unlevered firm is calculated as

rWACC = CF(1 – t)/V = EUR8.0 million/EUR100.0 million = 8.0%.

The market value of Plover with the debt financing is EUR107 million:

VL = VU + tD = EUR100.0 million + 0.20(EUR35.0 million) = EUR107.0 million.

To find the cost of equity, we first need to find the market value of equity:

VL = D + E, where D and E are market values of debt and equity, respectively.

E = EUR107.0 million – EUR35.0 million = EUR72.0 million.

The cost of equity is given by

re = r0 + (r0 − rd)(1 − t)D/E

= 8.0% + (8.0% – 4.5%)(0.80)(EUR35.0 million/EUR72.0 million) = 9.36%.

Plover’s WACC is calculated as follows:

WACC = (Weighting of debt × Cost of debt) + (Weighting of equity × Cost of equity)

= (EUR35 million/EUR107.0 million)(4.5%)(1 – 0.2) + (EUR72.0 million/ EUR107.0 million)(9.36%) = 7.48%, which is lower than the 8.0% for the unlevered firm.

我在考虑r0的时候直接用没有杠杆的条件下算的,即永续年金的模式求解得:10 /100=10%,请问下为什么r0就要考虑tax的影响?