NO.PZ202305230100003903

问题如下:

Match the following statements about forward rate curves with corresponding statements about spot rate curves.

解释:

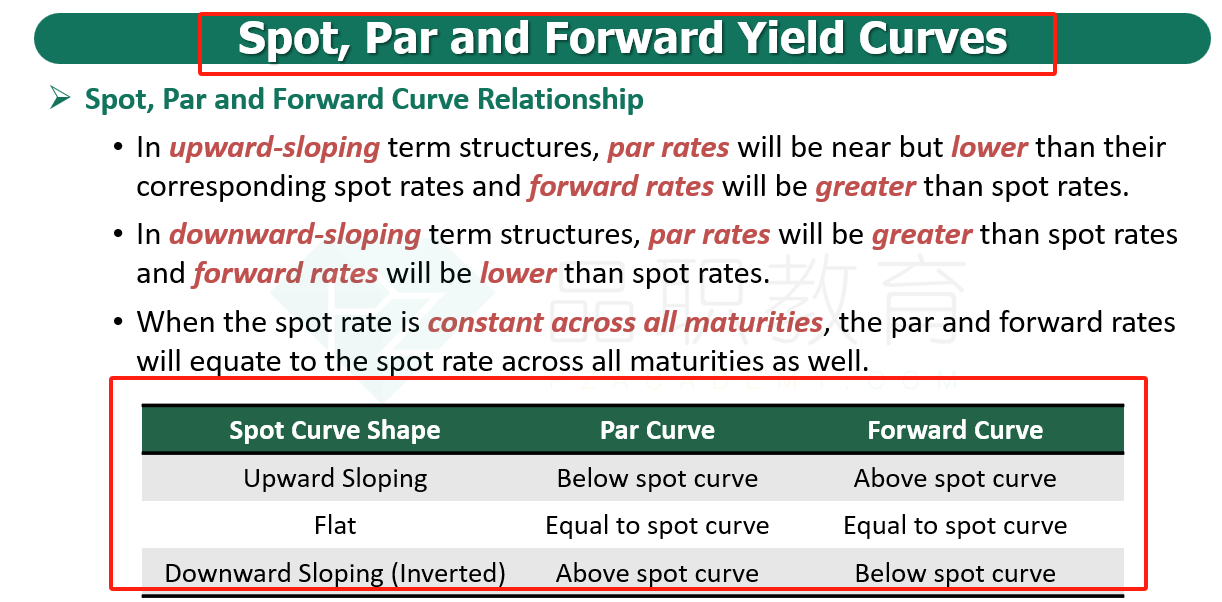

1. B. In a normal interest rate environment with an upward-sloping yield curve, forward interest rates will be greater than their corresponding spot rates across all maturities.

2. A. In an inverted spot rate environment, forward interest rates will be below their corresponding spot rates.

3. C. A flat maturity structure of interest rates is sometimes assumed. In such an environment in which spot rates are constant, this implies that future expectations are for interest rates to remain at a constant level. Thus, forward rates equal spot rates in a flat term structure environment.

能再解释下吗?另外用到了哪一个知识点啊