NO.PZ202105270100000404

问题如下:

Richard Martin is chief investment officer for the Trunch Foundation (the foundation), which has a large, globally diversified investment portfolio. Martin meets with the foundation’s fixed-income and real estate portfolio managers to review expected return forecasts and potential investments, as well as to consider short-term modifications to asset weights within the total fund strategic asset allocation.

Martin asks the real estate portfolio manager to discuss the performance characteristics of real estate. The real estate portfolio manager makes the following statements:

Statement 1: Adding traded REIT securities to an equity portfolio should substantially improve the portfolio’s diversification over the next year.

Statement 2: Traded REIT securities are more highly correlated with direct real estate and less highly correlated with equities over multi-year horizons.

Martin looks over the long-run valuation metrics the manager is using for commercial real estate, shown in Exhibit 1.

The real estate team uses an in-house model for private real estate to estimate the true volatility of returns over time. The model assumes that the current observed return equals the weighted average of the current true return and the previous observed return. Because the true return is not observable, the model assumes a relationship between true returns and observable REIT index returns; therefore, it uses REIT index returns as proxies for both the unobservable current true return and the previous observed return.

Martin asks the fixed-income portfolio manager to review the foundation’s bond portfolios. The existing aggregate bond portfolio is broadly diversified in domestic and international developed markets. The first segment of the portfolio to be reviewed is the domestic sovereign portfolio. The bond manager notes that there is a market consensus that the domestic yield curve will likely experience a single 20 bp increase in the near term as a result of monetary tightening and then remain relatively flat and stable for the next three years. Martin then reviews duration and yield measures for the short-term domestic sovereign bond portfolio in Exhibit 2.

The discussion turns to the international developed fixed-income market. The foundation invested in bonds issued by Country XYZ, a foreign developed country. XYZ’s sovereign yield curve is currently upward sloping, and the yield spread between 2-year and 10-year XYZ bonds is 100 bps.

The fixed-income portfolio manager tells Martin that he is interested in a domestic market corporate bond issued by Zeus Manufacturing Corporation (ZMC). ZMC has just been downgraded two steps by a major credit rating agency. In addition to expected monetary actions that will raise short-term rates, the yield spread between three-year sovereign bonds and the next highest-quality government agency bond widened by 10 bps.

Although the foundation’s fixed-income portfolios have focused primarily on developed markets, the portfolio manager presents data in Exhibit 3 on two emerging markets for Martin to consider. Both economies increased exports of their mineral resources over the last decade.

The fixed-income portfolio manager also presents information on a new investment opportunity in an international developed market. The team is considering the bonds of Xdelp, a large energy exploration and production company. Both the domestic and international markets are experiencing synchronized growth in GDP midway between the trough and the peak of the business cycle. The foreign country’s government has displayed a disciplined approach to maintaining stable monetary and fiscal policies and has experienced a rising current account surplus and an appreciating currency. It is expected that with the improvements in free cash flow and earnings, the credit rating of the Xdelp bonds will be upgraded. Martin refers to the foundation’s asset allocation policy in Exhibit 4 before making any changes to either the fixed-income or real estate portfolios.

Based on Exhibit 2 and the anticipated effects of the monetary policy change, the expected annual return over a three-year investment horizon will most likely be:

选项:

A.lower than 2.00%. B.approximately equal to 2.00%. C.greater than 2.00%.

解释:

B is correct.

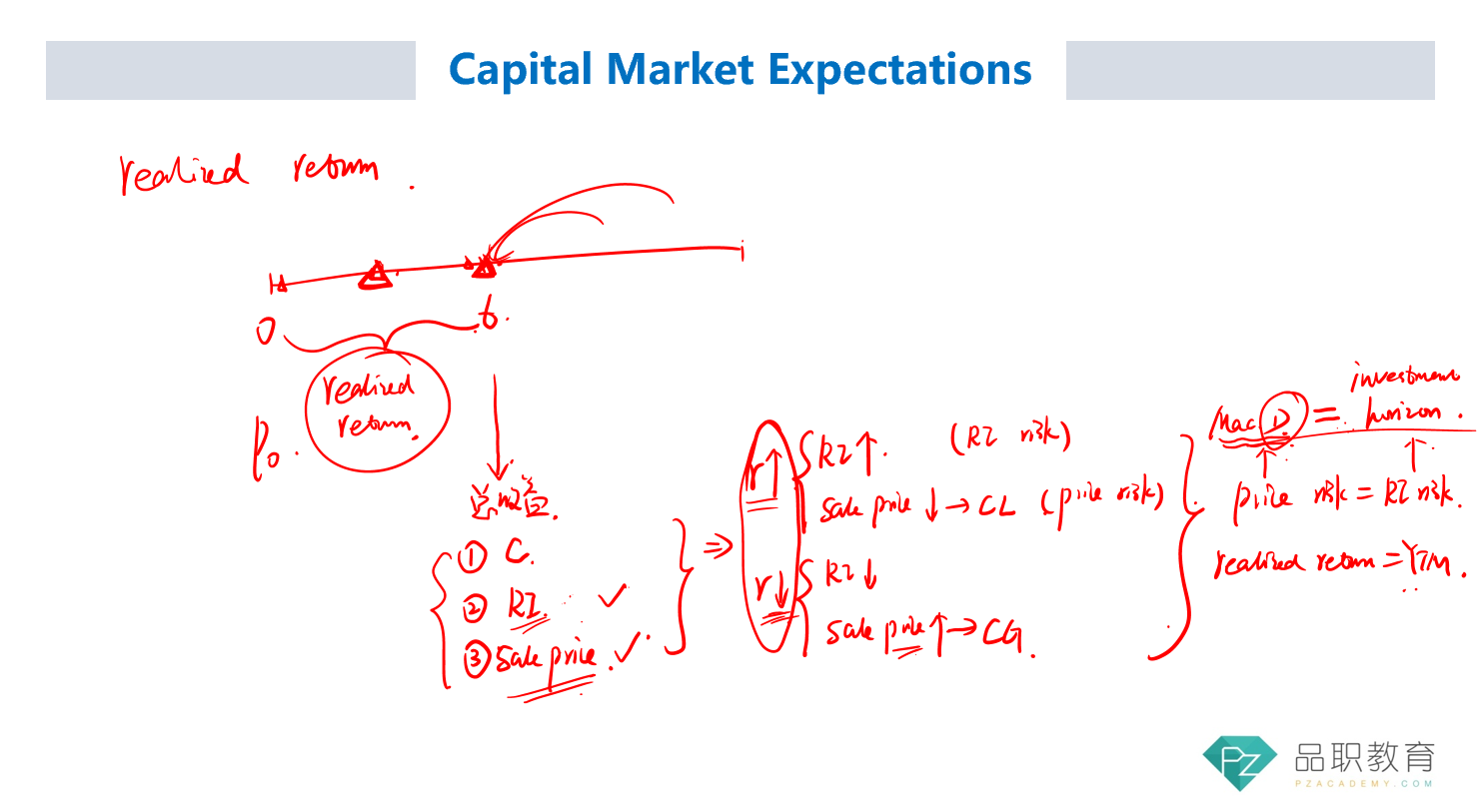

If the investment horizon equals the (Macaulay) duration of the portfolio, the capital loss created by the increase in yields and the reinvestment effects (gains) will roughly offset, leaving the realized return approximately equal to the original yield to maturity. This relationship is exact if (a) the yield curve is flat and (b) the change in rates occurs immediately in a single step. In practice, the relationship is only an approximation. In the case of the domestic sovereign yield curve, the 20 bp increase in rates will likely be offset by the higher reinvestment rate, creating an annual return approximately equal to 2.00%.

如果投资期限等于投资组合的(麦考利久期,收益率的增加和再投资效应(收益)造成的资本损失将大致抵消,使收益大致等于到期时的原始收益率。如果(a)收益率曲线是平坦的,并且(b)利率的变化立即在单一步骤中发生,则这种关系是准确的。实际上,这种关系只是一种近似。在国内主权收益曲线的情形中,20个基点的利率上升可能会被更高的再投资率所抵消,创造大约等于2.00%的年回报率。

老师好,这道题什么考点?是Investment horizon = Macaulay Duration时,expected return = YTM???