NO.PZ202206140600000104

问题如下:

An improvement in the explanation of AQI’s risk assessment process to a client is most likely to include that the:选项:

A.assessment is a bottom-up approach. B.fund manager’s risk assessment is the tracking risk relative to the benchmark. C.fund manager’s risk assessment incorporates only risk associated with security selection.解释:

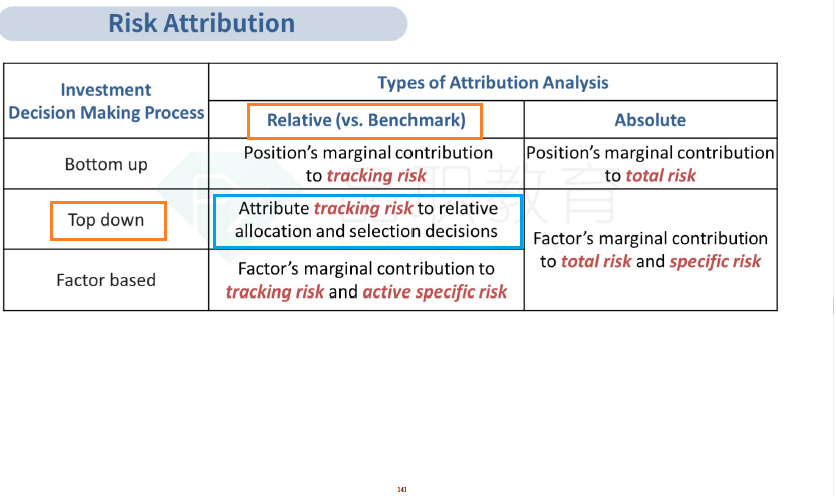

SolutionB is correct. AQI considers risk allocation based on sector allocation followed by within-sector security selection, which is a top-down approach. Because the assessment is relative to a benchmark, tracking risk relative to the benchmark is how the fund manager’s risk assessment is measured.

A is incorrect. AQI considers risk allocation based on sector allocation followed by within-sector security selection, which is a top-down approach.

C is incorrect. Fund manager sector allocation and security selection both create additional risk relative to the benchmark.

Timmon discusses how AQI considers risk allocation based on sector allocation followed by within-sector security selection. She clarifies that the risk assessment is relative to a benchmark and states that AQI is always looking for ways to improve the explanation of the process to potential clients.

这段话语言很晦涩,怎么理解,另外如何与讲义上Risk attribution 部分联结起来解题?