NO.PZ2023090504000008

问题如下:

A company’s management team, whose compensation includes significant stock grants and options, is pursuing a large debt-financed acquisition. The management team discusses how this acquisition may not align with the interests of all stakeholders, and it is proposed that they increase equity financing for the acquisition. Increasing equity financing for the transaction would increase support by which stakeholder?

选项:

A.Debtholders

Management

Shareholders

解释:

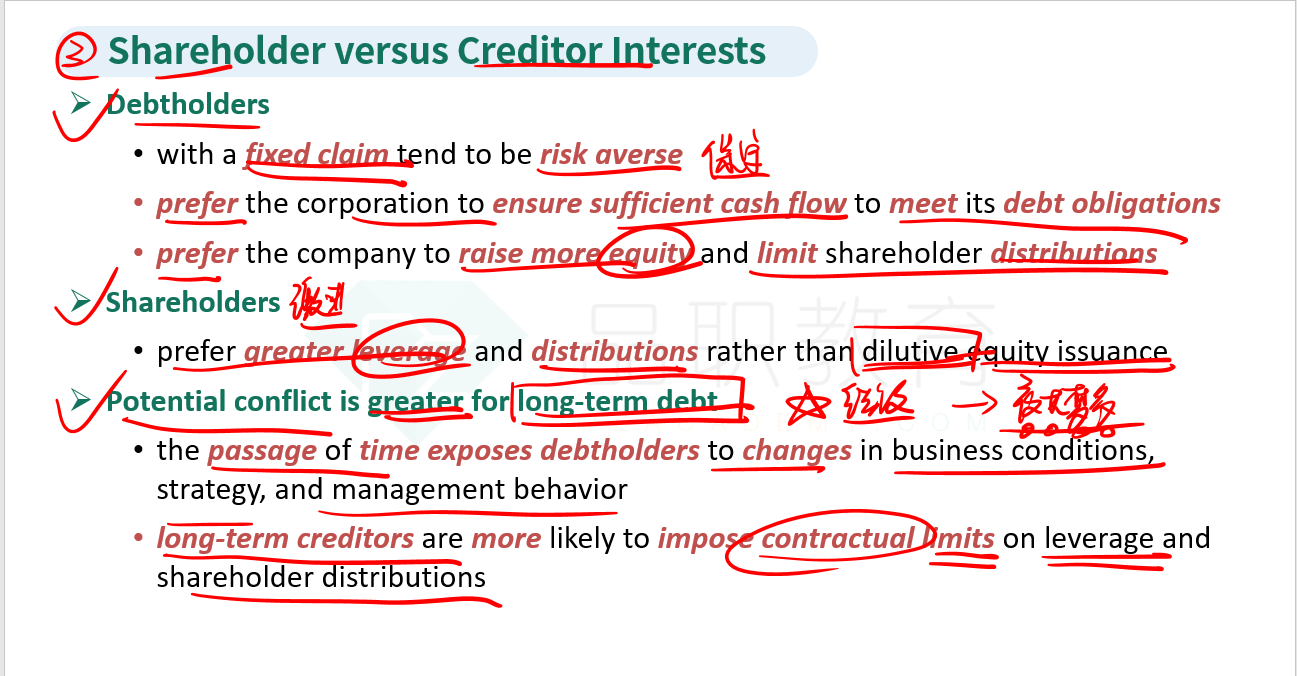

A is correct. Debtholders with a fixed claim tend to be risk averse and prefer that the corporation take actions to ensure sufficient cash flow to meet its debt obligations. For this reason, debtholders tend to prefer that a company raise more equity as opposed to increasing debt to a level that may increase default risk.

B and C are incorrect, because management is aligned with shareholders through stock grants and options, and shareholders tend to prefer greater leverage rather than dilutive equity issuance.

为什么c 不对呢?