NO.PZ2023020101000004

问题如下:

Sheroda determined she was also

underweight in one individual stock. Thirty days ago, she entered a long 60-day

forward position on CHJ common stock, which does not pay a dividend. Sheroda

has asked Parisi to calculate the value of her two forward positions today—that

is, 30 days after the contracts were initiated. Parisi has collected the

information in Exhibit 1 to carry out the valuation assignment.

Exhibit

1: Selected Financial Information for Sheroda Meeting

Based on the information in Exhibit 1 and

assuming a 360-day year, the value of Sheroda’s forward contract on the CHJ

stock is closest to:

选项:

A.3.99 USD.

–3.98 USD.

–4.29 USD.

解释:

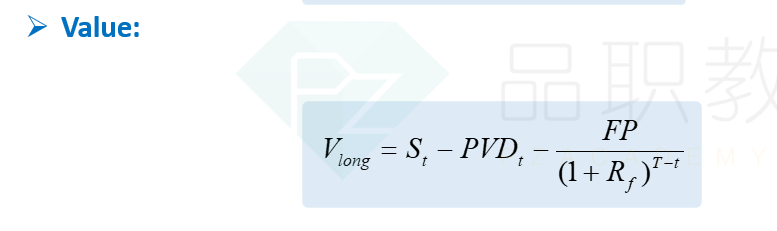

B is

correct. The value of the forward contract is:

Vt(T) = PVt,T[Ft(T) – F0(T)]

= (96.31 – 100.30) /(1.003944)^(30/360)= –3.98

,您好,我不太理解里面的答案和助教的解释(已经贴在下方),首先疑惑助教解释:96.31=96*(1+rf)(30/360)这个地方,为什么拿stock来算forward,不是forward算一方,stock算一方?而且按照stock没有复利?

当前sotck在30后是96,30天后的forward当前时点价格是96.31(60天到期的0),(60天到期的forward是96),不是用(96.31-96)*3.92%^(30/360)?

而且这题目还不全,看答案是有个复利3.92%

“” 此题是equity forward的valuation,按照教材的讲述,对于单个的stock而言,一般都不采用连续复利的,同学的疑问是对的。首先我们可以根据96.31=96*(1+rf)(30/360),反解出rf=3.94457%,Vt(T)=(96.31 – 100.30)/(1.00394457)(30/360)=-3.98。由于时间期限较短,所以采用连续复利和非连续复利计算的结果是一样的。这道题的解析确实存在一点问题,我们已经在后台做了处理。同学能够发现这个问题,证明同学对于此知识点的掌握是非常扎实的哦,非常棒“”

其次答案= e–0.0392(30/360)(96.31 – 100.30)? 不是long forward ?"Thirty days ago, she entered a long 60-day forward position on CHJ common stock, which does not pay a dividend."这题万全不用考虑96的stock?单独算forward这方?