NO.PZ2023010407000013

问题如下:

Xu and Johnson is co-worker for the south University Endowment Fund (the Fund). The Fund’s investment committee recently decided to add hedge funds to the Fund’s portfolio to increase diversification.And then they discuss various hedge fund strategies that might be suitable for the Fund. Johnson tells Xu the following:

Statement 1 Relative value strategies tend not to use leverage.

Statement 2 Long/short equity strategies usually do not exposed to equity market beta risk.

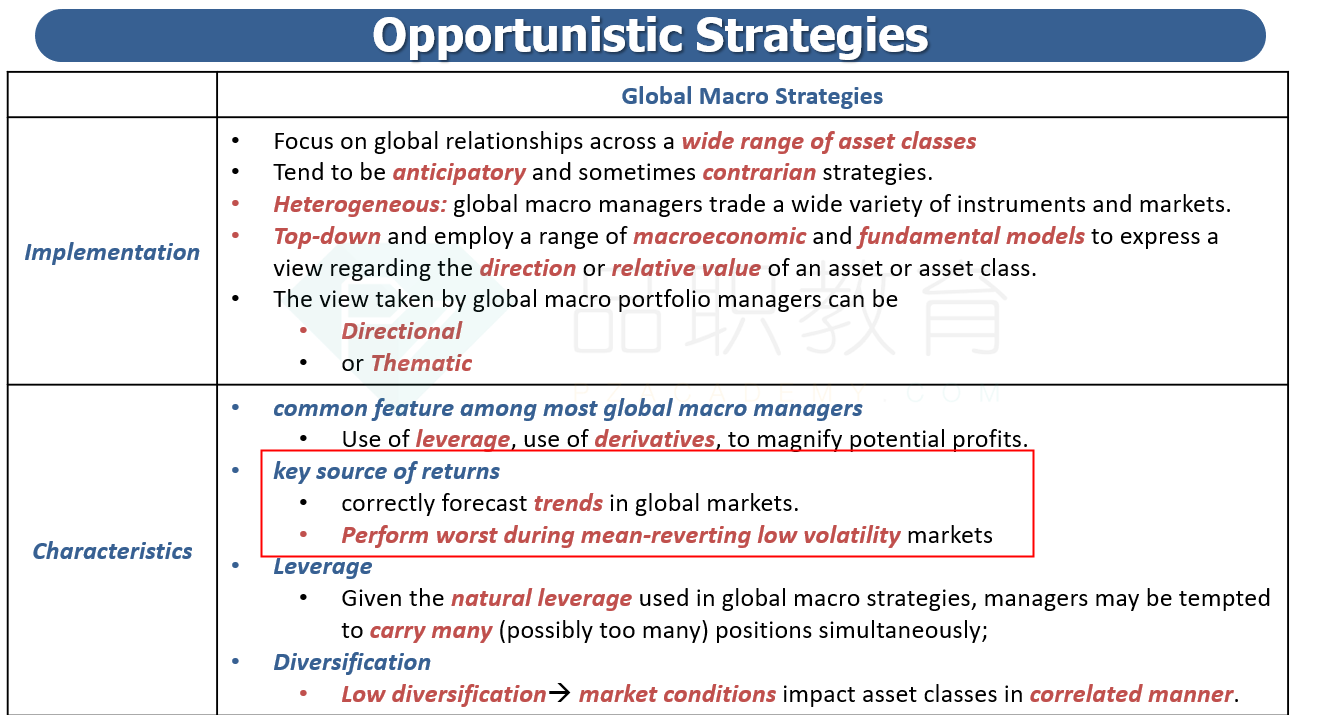

Statement 3 Global macro strategies will naturally have higher volatility in the return profiles typically delivered.

Which of Johnson’s three statements regarding hedge fund strategies is correct?

选项:

A.

Statement 1

B.

Statement 2

C.

Statement 3

解释:

C is correct. Global macro investing may introduce natural benefits of asset class and investment approach diversification, but they come with naturally higher volatility in the return profiles typically delivered. The exposures selected in any global macro strategy may not react to the global risks as expected because of either unforeseen contrary factors or global risks that simply do not materialize; thus, macro managers tend to produce somewhat lumpier and more uneven return streams than other hedge fund strategies.

A is incorrect because relative value hedge fund strategies tend to use significant leverage that can be dangerous to limited partner investors, especially during periods of market stress. During normal market conditions, successful relative value strategies can earn credit, liquidity, or volatility premiums over time. However, in crisis periods when excessive leverage, deteriorating credit quality, illiquidity, and volatility spikes come to fruition, relative value strategies can result in losses.

B is incorrect because long/short equity strategies tend to be exposed to some natural equity market beta risk but have less beta exposure than simple long-only beta allocations. Given that equity markets tend to rise over the long run, most long/short equity managers typically hold net long equity positions with some managers maintaining their short positions as a hedge against unexpected market downturns.

就是说这种投资,又波动大,又右偏?