NO.PZ2023020101000017

问题如下:

Whitney meets with Grand Manufacturing.

This client is based in Hong Kong but requires a €25,000,000 one-year bridge

loan to fund operations in Germany. Grand Manufacturing is currently able to

borrow euros at an interest rate of 3.75% but wonders if there is a less

expensive alternative. Whitney advises Grand to borrow in HK$ and enter into a

one-year foreign currency swap with quarterly payments to receive euros at a

fixed rate and pay HK$ at a fixed rate. The current exchange rate is HK$11.42

per €1, and the notional amounts will be exchanged at initiation and at

maturity.

Exhibit

1 Current Term Structure of Rates (%)

Note: Libor is the

London Interbank Offered Rate. Euribor is the Euro Interbank Offered Rate.

Hibor is the Hong Kong Interbank Offered Rate. All rates shown are annualized.

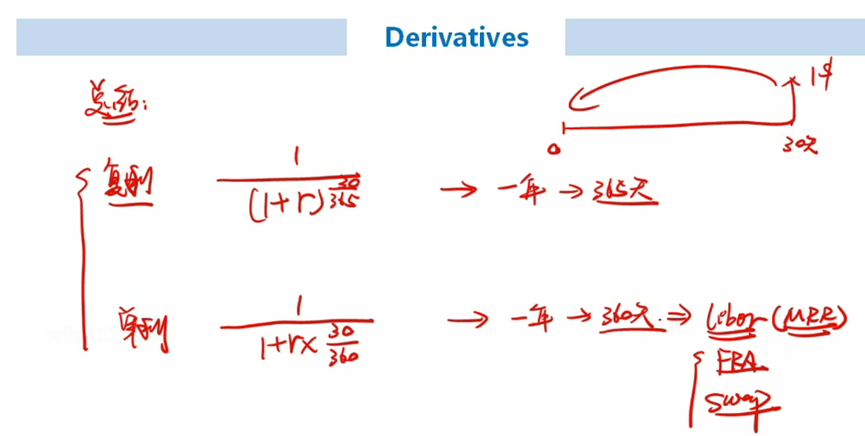

Based on the

information in Exhibit 1 and using a 30/360 day count, the annualized fixed

rates on the currency swap suggested by Whitney for Grand for euros and Hong

Kong dollars, respectively, will be closest to:

选项:

A.2.34%

and 1.87%.

2.13%

and 1.58%.

C.

2.32%

and 1.85%.

解释:

C is correct. The appropriate PV factors

for Euribor and Hibor are calculated from Exhibit 1.

The annualized rate is simply (360/90)

times the 90-day rates or 2.3181% for Euros and 1.8550% for HK$.

我算的B90=1/(1+1.86%)^0.25=0.995403