NO.PZ2022122701000042

问题如下:

Scott Bloomstone, Managing Director at Crestwood, has performed the investment manager due diligence and is presenting his findings to the Riverdale Investment Committee. Bloomstone presents the upside and downside capture ratios of the top three investment manager candidates as shown in Exhibit 1.

The investment manager that exhibits a positive asymmetry in its historical returns is most likely represented by:

选项:

A.Oakfarm Investments.

Sailboat Asset Management.

TripleCircle Investors.

解释:

Correct Answer: C

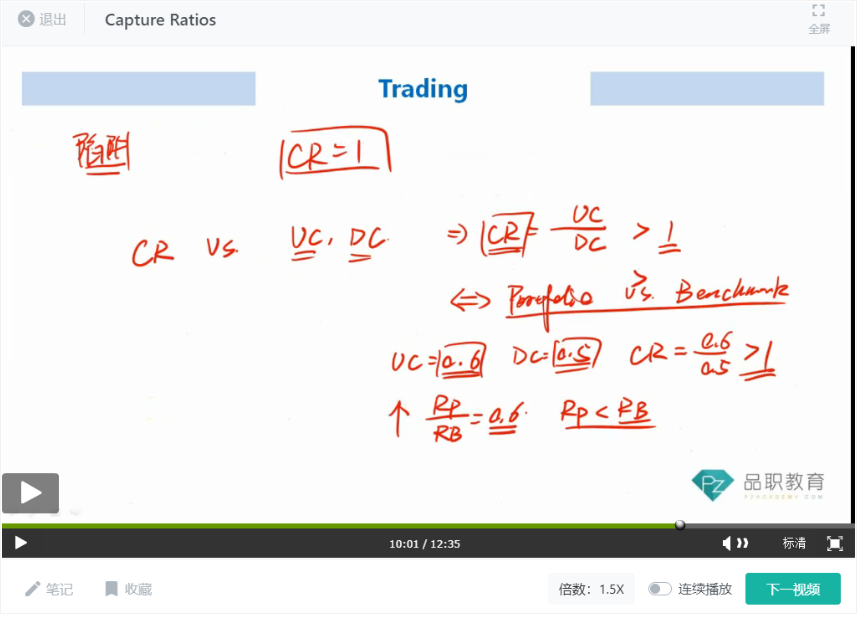

Capture ratio is the upside capture divided by the downside capture. It measures the asymmetry of return. A capture ratio greater than one indicates positive asymmetry, or a convex return profile, whereas a capture ratio less than one indicates a negative asymmetry, or concave return profile.

Capture ratio = Upside capture/ Downside capture

Capture ratio calculations for each firm are shown below.

Oakfarm Investments = 75/75 = 1

Sailboat Asset Management = 90/125 = 0.72

TripleCircle Investors = 90/75 = 1.2

按照capture ration >1来判断固然没错

但是,上涨只有90%,不如bench,下跌却只有70%,远好于bench,不是应该下跌的时候表现更好吗?所以不应该是negative偏左吗?