NO.PZ2022101402000008

问题如下:

An analyst is estimating a historical ERP for a market based on the following information.

The historical ERP is closest to:

选项:

A.

3.15%

B.

6.81%

C.

9.96%

解释:

B is correct.

The ERP using the historical approach is calculated as the mean value of the difference between a broad-based equity market index return and a government debt return. Therefore, the ERP using the historical approach is calculated as 9.96% – 3.15% = 6.81%.

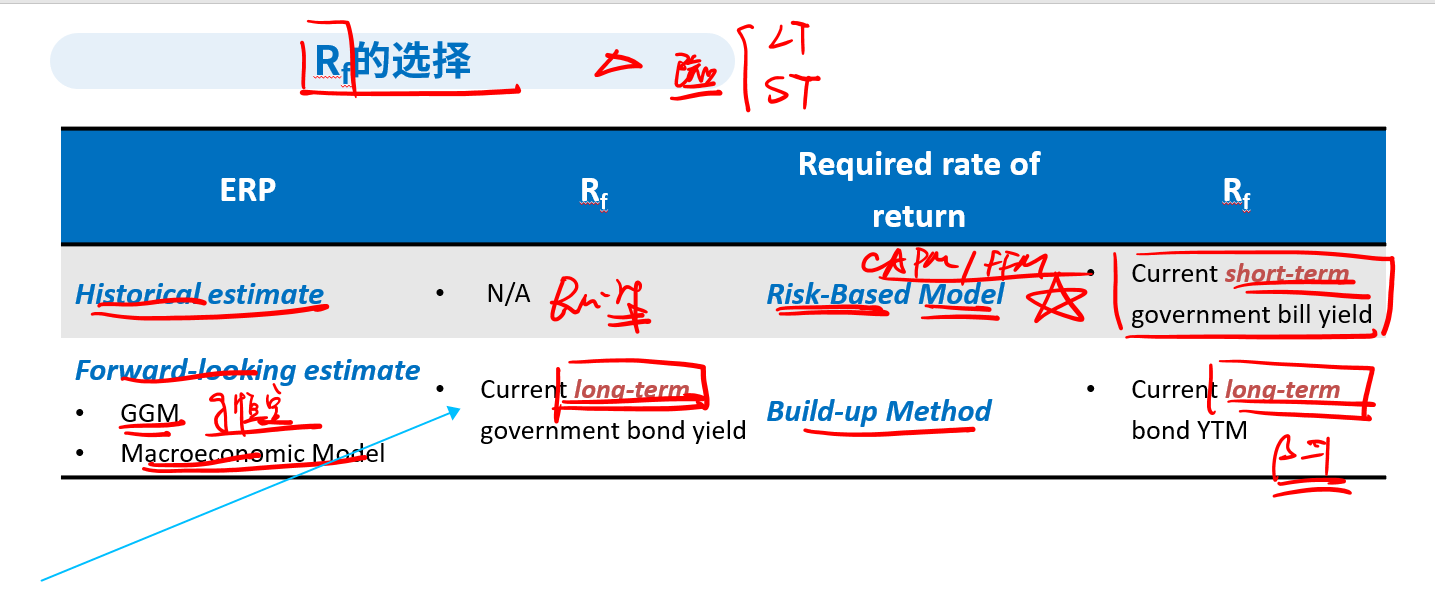

如果用未来法,公式里最后要减一个Rf,为什么是用0.96%这个值,讲义里没提到要用current yield?