NO.PZ2022122701000039

问题如下:

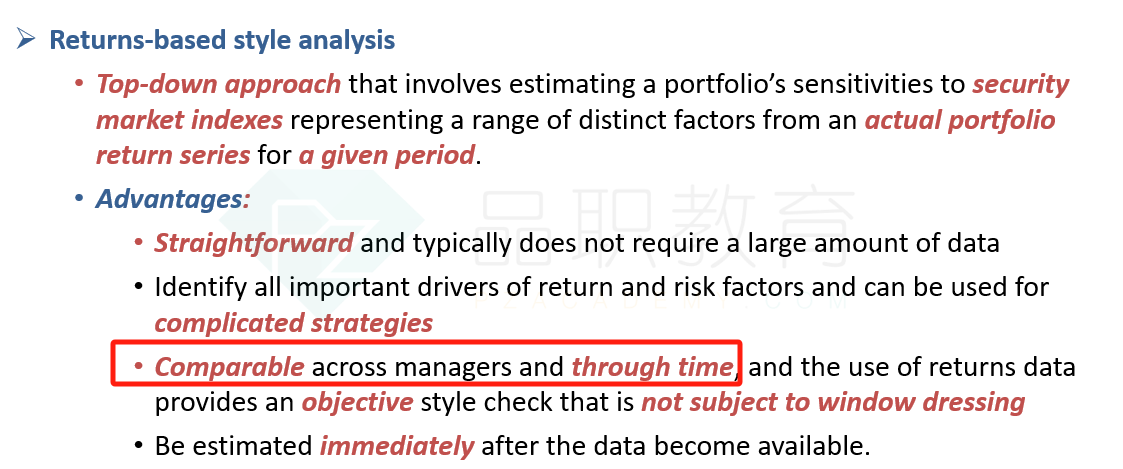

An advantage of a returns-based style analysis is that such analysis:

选项:

A.is comparable across managers.

is suitable for portfolios that contain illiquid securities.

can effectively profile a manager’s risk exposures using a short return series.

解释:

Correct Answer: A

Returns-based style analysis on portfolios of liquid assets is generally able to identify the important drivers of return and the relevant risk factors for the period analyzed, even for complicated strategies. In addition, the process is comparable across managers and through time. If the portfolio contains illiquid securities, the lack of current prices on those positions may lead to an underestimation of the portfolio’s volatility in a returns-based style analysis. Longer return series generally provide a more accurate estimate of the manager’s underlying standard deviation of return.

框架图中讲的是holding-based的优点是be comparable through time