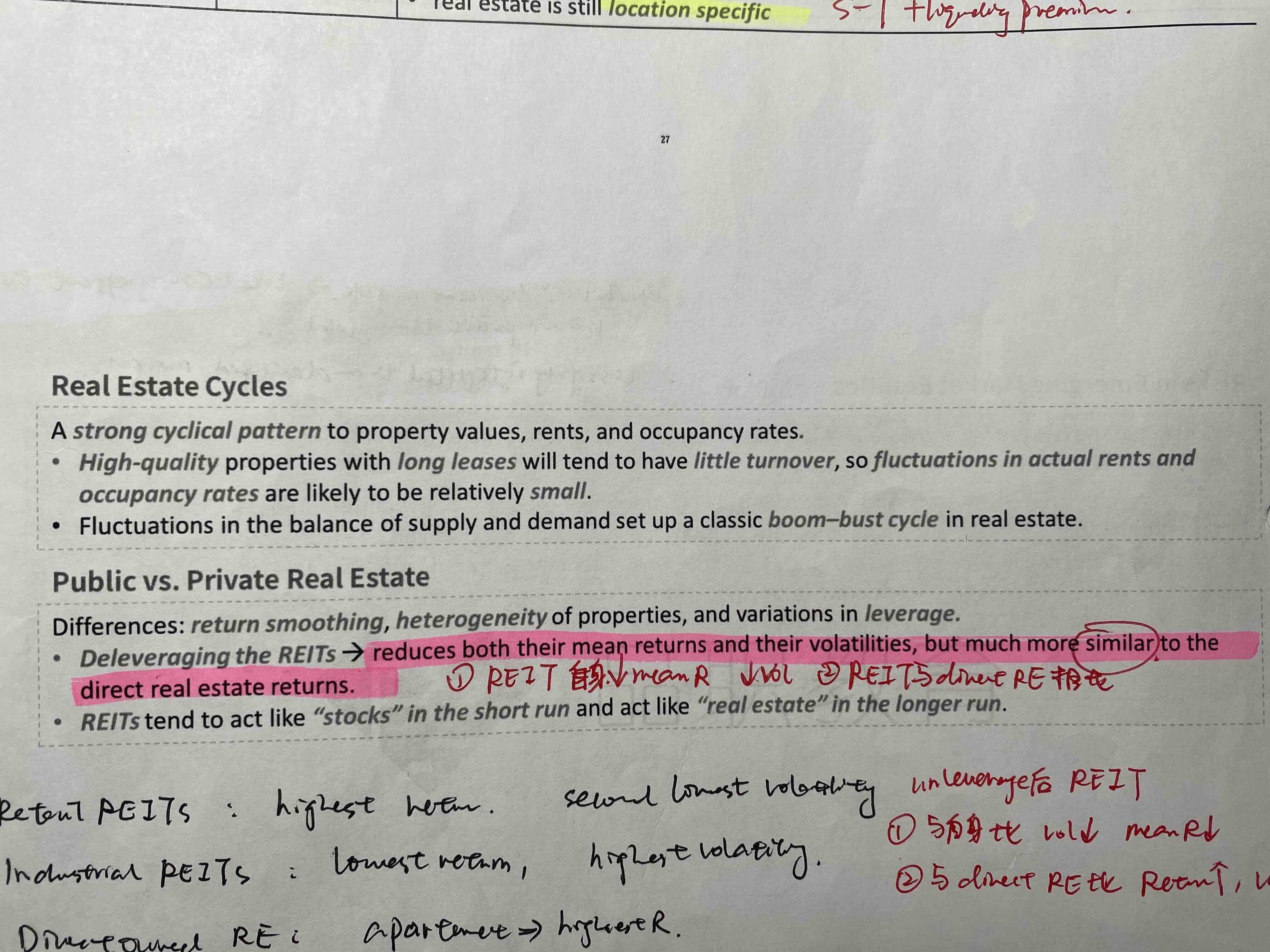

老师,有两个问题:1. 讲义上说 deleveraging REIT 会降低volatility 和return 但书上说: when adjusting for leverage,REIT show higher returns and lower volatility than direct real estate. 两者return一低一高,不一样的原因是什么?是因为第一句话是REIT 去杠杆后与REIT自己比return 会降低,第二句是REIT去杠杆后与direct RE 比return会更高是吗?2. 书上后半句说 the difference may be due to investors capturing higher liquidity premium in direct RE invest.意思是direct investment 有 high return,这与上一句 REIT show higher returns and lower volatility than direct real estate (REIT的return高)不是矛盾了吗?