NO.PZ202310070100000104

问题如下:

Assuming both companies have similar equity multipliers, OldShips is most likely to have a:

选项:

A.

much lower ROE than CleanYards

B.

similar ROE to CleanYards’.

C.

much higher ROE than CleanYards.

解释:

B is correct; ROE = DTL × Asset turnover × Equity multiplier.

OldShips has half the degree of CleanYards’ total leverage. However, its asset turnover is double CleanYards’ (0.84× versus 0.42×). Since the equity multiplier is the same, their ROEs must be similar.

Degree of total leverage (DTL) = DFL × DOL = (% Δ Net income/% Δ Operating income) × (% Δ Operating income/% Δ Q).

Thus, OldShips’ DTL = 2 × 1 = 2, whereas CleanYards’ DTL = 2 × 2 = 4.

A and C are incorrect, because both companies must have similar ROEs.

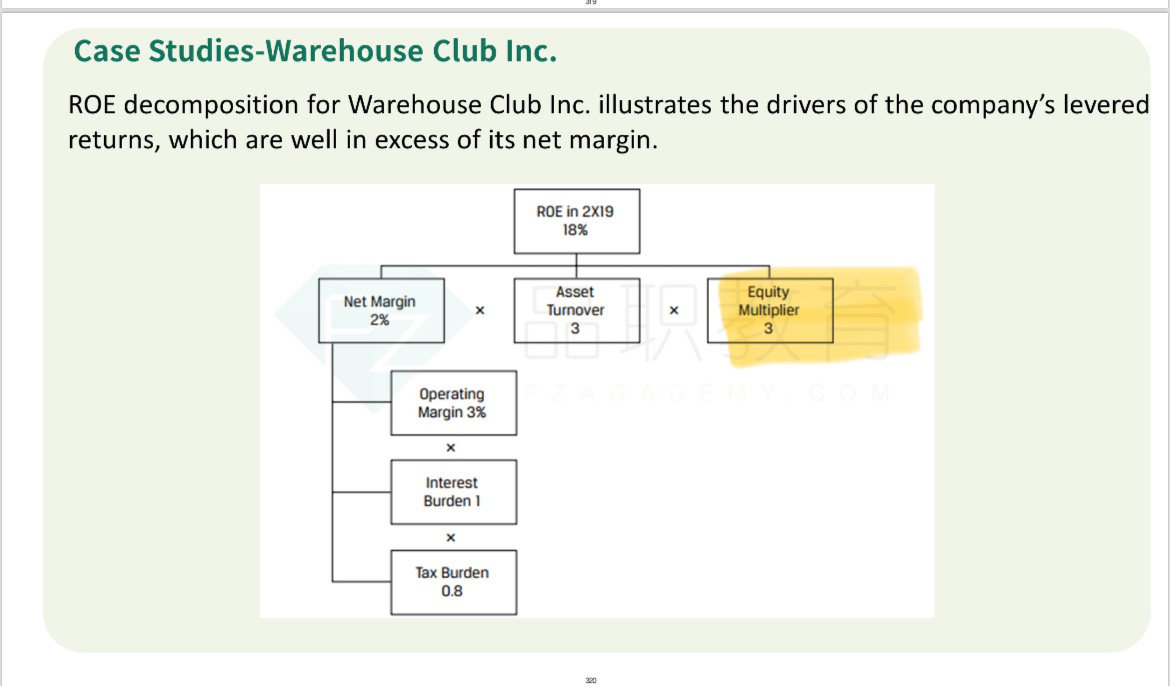

DOL×DFL=净利润率,也就是说杜邦三因子分析里面第一个指标有了,题干里给了总资产周转率(第二个指标),还缺少第三个指标即A/E