NO.PZ2023090507000010

问题如下:

Company X has the following on the right-hand side of its balance sheet:

- Bonds $400,000

- Common stock (40,000 shares) $600,000

- Total liabilities and equity $1,000,000

If the marginal corporate tax rate is 20% and the stock price increases to $25, the WACC for Company X is closest to:

选项:

A.7.60%.

8.26%.

8.55%.

解释:

B is correct.

The book value weights are computed as follows:

Wd = $400,000/$1,000,000 = 0.40.

We = $600,000/$1,000,000 = 0.60.

The market value of equity is equal to $25 × 40,000 shares = $1,000,000.

The market value weights are computed as follows:

Wd = $400,000/$1,400,000 = 0.29.

We = $1,000,000/$1,400,000 = 0.71.

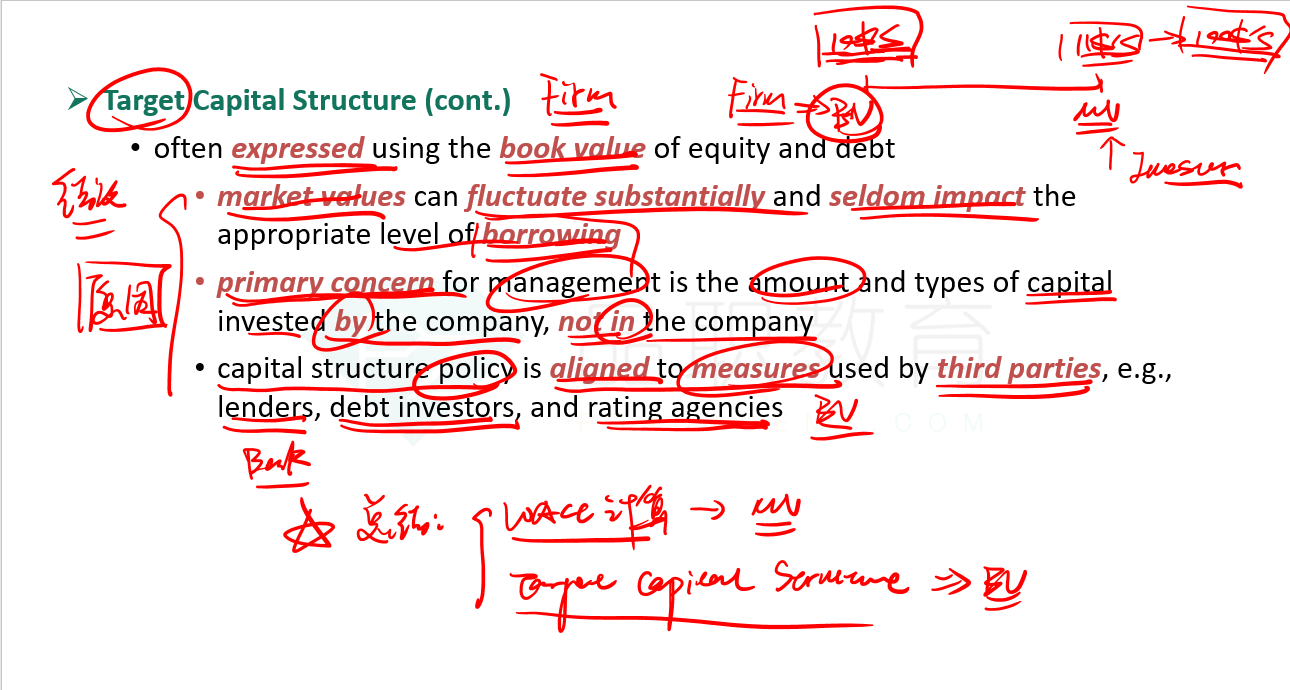

The appropriate weights for the WACC calculation are the market weights Company X’s WACC, using the market weights, is calculated as follows:

WACC = (weighting of debt * cost of debt) + (weighting of equity * cost of equity)

= (0.29) (5%)(1-0.2) +(0.71)(10%) = 8.26%

如题。

另外题目图中的4000+6000,是账面价值吗?这种在B/S表中的数值,不会因为股票价格的变动而变动吗?