NO.PZ2023032703000038

问题如下:

Beatriz Maestre is a fixed-income consultant who has been retained by Filipe Ruelas, the CFO of Cávado Produtos Agricolas, SA (Cávado). Cávado is a manufacturer of prepared foods headquartered in Braga, Portugal.

During the meeting, Maestre presents some information about Cávado’s pension fund, which is primarily invested in corporate bonds with a mixture of investment-grade and speculative-grade issues. This information is presented in Exhibit 1.

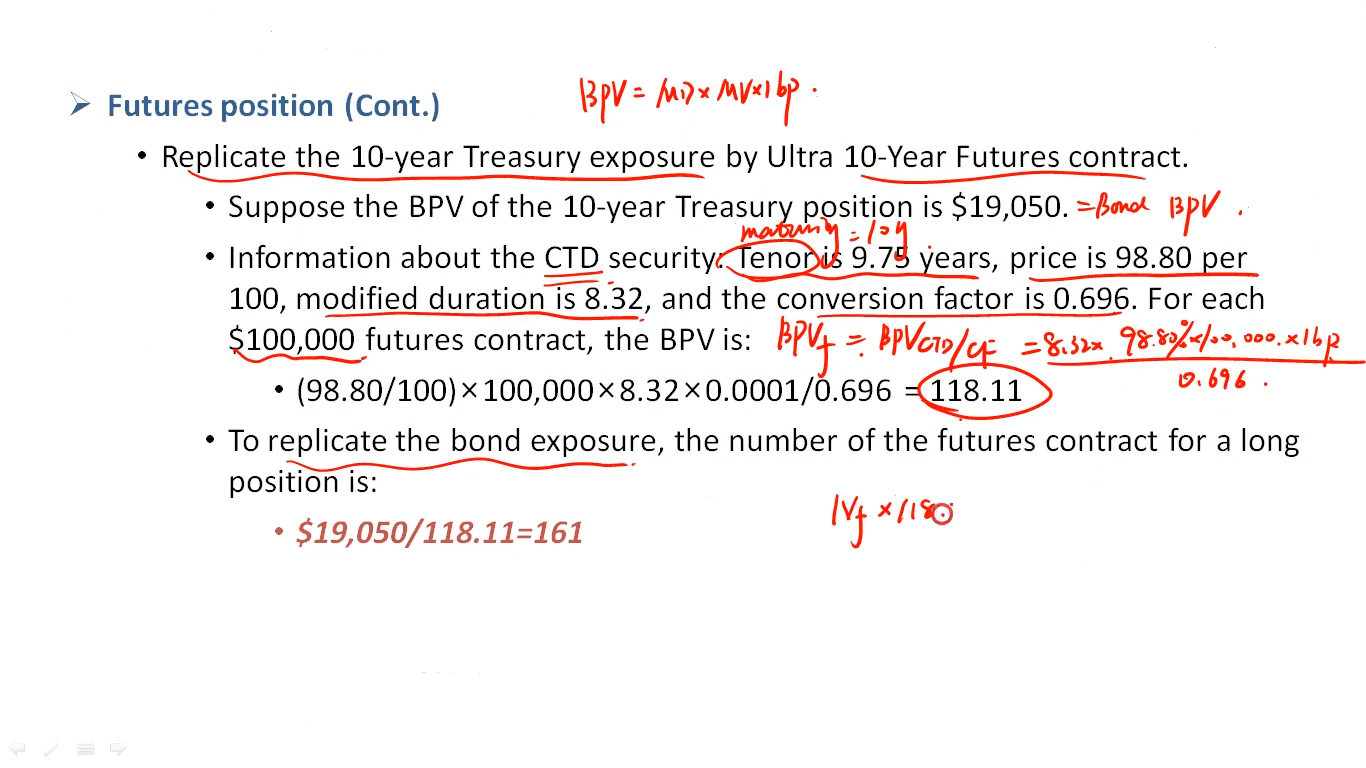

Ruelas explains that he uses futures contracts on euro-denominated German government bonds to reduce the duration gap between assets and liabilities. However, because the pension fund has only a small surplus and he would like to increase this surplus through active management of the portfolio, he employs a contingent immunization strategy. The fund is currently short 254 contracts based on a 10-year bond with a par value of EUR 100,000 and a basis point value (BPV) of EUR 97.40 per contract.

Given the futures position entered into by the pension fund, Ruelas most likely believes interest rates will:

选项:

A.fall.

B.

rise.

C.

remain the same.

解释:

A is correct. The number of futures contracts needed to fully remove the duration gap between the asset and liability portfolios is given by Nf = (BPVL – BPVA)/BPVf, where BPV is basis point value (of the liability portfolio, asset portfolio, and futures contract, respectively). In this case, Nf = (59,598 – 91,632)/97.4 = –328.891, where the minus sign indicates a short position or selling of 329 futures contracts (328,891/1,000). Ruelas has under-hedged, leaving a net position that will benefit from a reduction in interest rates, just as the unhedged position would benefit from a reduction in interest rates. Thus, he must believe interest rates will fall.

B is incorrect because if Ruelas believed rates would rise, he would under-hedge, leaving a net position that would benefit from rising rates.

C is incorrect because if Ruelas believed rates wouldn’t change, he would hedge fully, in case rates moved in an unexpected way.

题目给了futures面值是不是都用不上,只需要用BPV算?什么时候要用到呢