NO.PZ2015122802000166

问题如下:

An analyst gathers or estimates the following information about a stock:

Based on a dividend discount model, the stock is most likely:

选项:

A.undervalued.

B.fairly valued.

C.overvalued.

解释:

A is correct.

The current price of €22.56 is less than the intrinsic value (V0) of €24.64; therefore, the stock appears to be currently undervalued. According to the two-stage dividend discount model:

and

Dn+1 = D0(1+gS)n(1+gL)

D1 = €1.60 × 1.09 = €1.744

D2 = €1.60 × (1.09)2 = €1.901

D3 = €1.60 × (1.09)3 = €2.072

D4 = €1.60 × (1.09)4 = €2.259

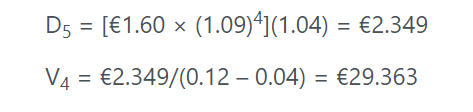

D5 = [€1.60 × (1.09)4](1.04) = €2.349

V4 = €2.349/(0.12 – 0.04) = €29.363

= 1.557+1.515+1.475+1.436+18.661

= €24.64(which is greater than the current price of €22.56)

考点:Multi-stage Model

计算器具体步奏如下:

CFO=0, C01=1.744,F01=1,C02=1.901,F02=1,C03=2.072,F03=1,C04=2.259+29.363,F04=1,NPV , I=12,CPT NPV

请问V4的分母是应该是D5的数值还是D5(1+4%)?