NO.PZ2020010304000016

问题如下:

Suppose that the annual profit of two firms, one an incumbent (Big Firm, X1) and the other a startup (Small Firm, X2), can be described with the following probability matrix:

What are the conditional expected profit and conditional standard deviation of the profit of Big Firm when Small Firm either has no profit or loses money (X2 ≤ 0)?

选项:

A.

3.01; 30.52

B.

3.01; 931

C.

1.03; 30.52

D.

1.03; 931.25

解释:

We need to compute the conditional distribution given X2 ≤ 0. The relevant rows of the probability matrix are

The conditional distribution can be constructed by summing across rows and then normalizing to sum to unity. The non-normalized sum and the normalized version are

Finally, the conditional expectation is E[X1|X2 ≤0] = Σx1Pr(X1 = x1|X2 ≤0) = USD 3.01M.

The conditional expectation squared is E[X1^2|X2 ≤0]=940.31, and so

the conditional variance is V[X1] = E[X1^2] - E[X1]^2 =940.31-3.01^2=931.25

and the conditional standard deviation is USD 30.52M.

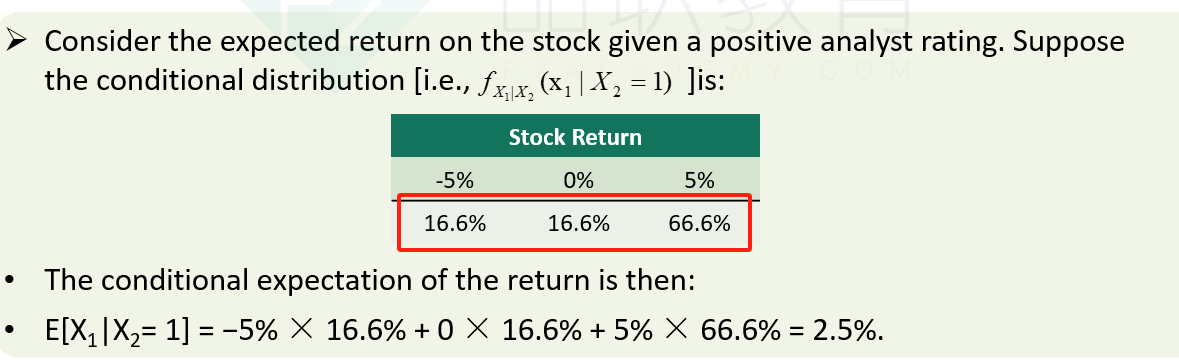

讲义slide 71关于conditional expectation的例题中,stock return 三个概率加起来也是不到100。但是最后解conditional expectation时也是直接用题目中的概率。请问为什么这道题要Normalized啊?没搞懂,可以解释一下吗?