NO.PZ2023090507000014

问题如下:

MM Proposition II without taxes differs from MM Proposition I without taxes since it concludes that:

选项:

A.

WACC is unaffected by capital structure.

B.

the value of the levered firm is equal to that of the unlevered firm.

C.

higher leverage raises the cost of equity, which exactly offsets the lower cost of debt.

解释:

C is correct.

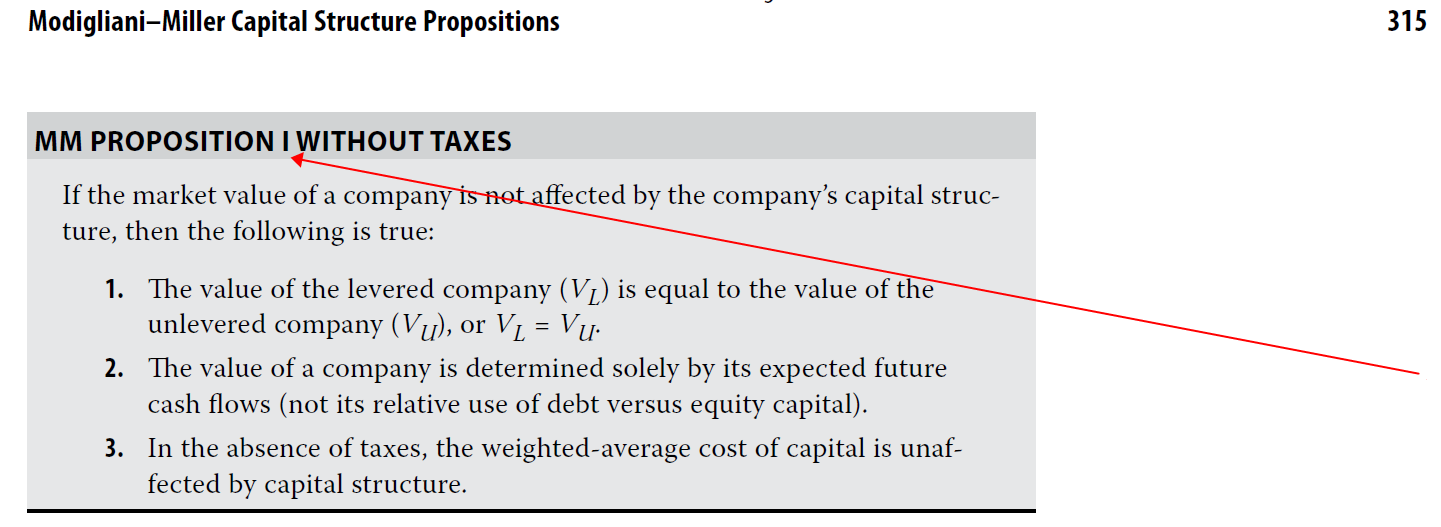

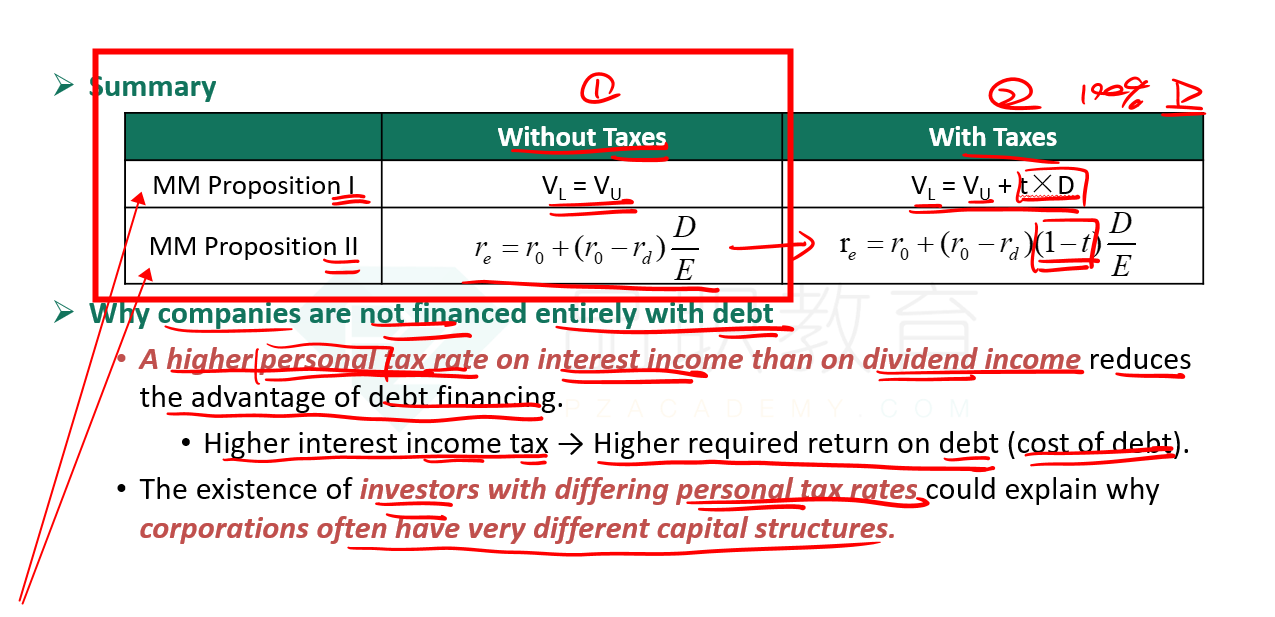

MM Proposition II without taxes differs from MM Proposition I without taxes in that the cost of equity will rise with leverage and completely offset the lower cost of debt. Debt has a lower cost relative to equity because debtholders have a priority claim on the cash flow of the firm. So, one would expect WACC to decline with more debt. MM Proposition II without taxes argues that the cost of equity is a linear function of the debt-to-equity ratio. The addition of more low-cost debt to the capital structure will increase the debt-to-equity ratio and raise the cost of equity, offsetting the lower debt cost. As a result, the firm’s WACC is unchanged.

同标题 b 为什么不对呢