NO.PZ2018031301000005

问题如下:

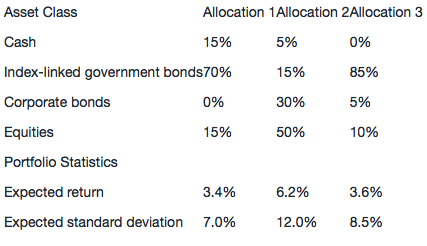

Viktoria Johansson is newly appointed as manager of ABC Corporation’s pension fund. The current market value of the fund’s assets is $10 billion, and the present value of the fund’s liabilities is $8.5 billion. The fund has historically been managed using an asset-only approach, but Johansson recommends to ABC’s board of directors that they adopt a liability-relative approach, specifically the hedging/return-seeking portfolios approach. Johansson assumes that the returns of the fund’s liabilities are driven by changes in the returns of index-linked government bonds. Exhibit 1 presents three potential asset allocation choices for the fund.

Exhibit 1 Potential Asset Allocations Choices for ABC Corp’s Pension Fund

Determine which asset allocation in Exhibit 1 would be most appropriate for Johansson given her recommendation. Justify your response.

选项:

解释:

■ Allocation 3 is

most appropriate.

■ To fully hedge the fund’s liabilities, 85% ($8.5 billion/$10.0 billion) of

the fund’s assets would be linked to index-linked government bonds.

■ Residual $1.5 billion surplus would be invested into a return-seeking portfolio.

The pension fund currently has a surplus of $1.5 billion ($10.0 billion – $8.5 billion). To adopt a hedging/return-seeking portfolios approach, Johansson would first hedge the liabilities by allocating an amount equal to the present value of the fund’s liabilities, $8.5 billion, to a hedging portfolio. The hedging portfolio must include assets whose returns are driven by the same factors that drive the returns of the liabilities, which in this case are the index-linked government bonds.

So, Johansson should allocate 85% ($8.5 billion/$10.0 billion) of the fund’s assets to index-linked government bonds. Te residual $1.5 billion surplus would then be invested into a return-seeking portfolio. Therefore, Allocation 3 would be the most appropriate asset allocation for the fund because it allocates 85% of the fund’s assets to index-linked government bonds and the remainder to a return seeking portfolio consisting of corporate bonds and equities.

Allocation 1 is appropriate, because:

the basic form is suitable for overfunded portfolio

invest should be conseavative, the volatility of allocation1 is lowest

stability and liquidity should be considered , there is cash in allocation 1

invest in index-linked government bonds can match the risk factor of liability better

以上哪里错了