NO.PZ201909280100001102

问题如下:

Eileen Gension is

a portfolio manager for Zen-Alt Investment Consultants (Zen-Alt), which assists

institutional investors with investing in alternative investments. Charles

Smittand is an analyst at Zen-Alt and reports to Gension. Gension and Smittand

discuss a new client, the Benziger University Endowment Fund (the fund), as

well as a prospective client, the Opeptaja Pension Plan (the plan).

The fund’s current

portfolio is invested primarily in public equities, with the remainder invested

in fixed income. The fund’s investment objective is to support a 6% annual

spending rate and to preserve the purchasing power of the asset base over a

10-year time horizon. The fund also wants to invest in assets that provide the

highest amount of diversification against its dominant equity risk. Gension

considers potential alternative investment options that would best meet the

fund’s diversification strategy.

In preparation for

the first meeting between Zen-Alt and the fund, Gension and Smittand discuss

implementing a short-biased equity strategy within the fund. Smittand makes the

following three statements regarding short-biased equity strategies:

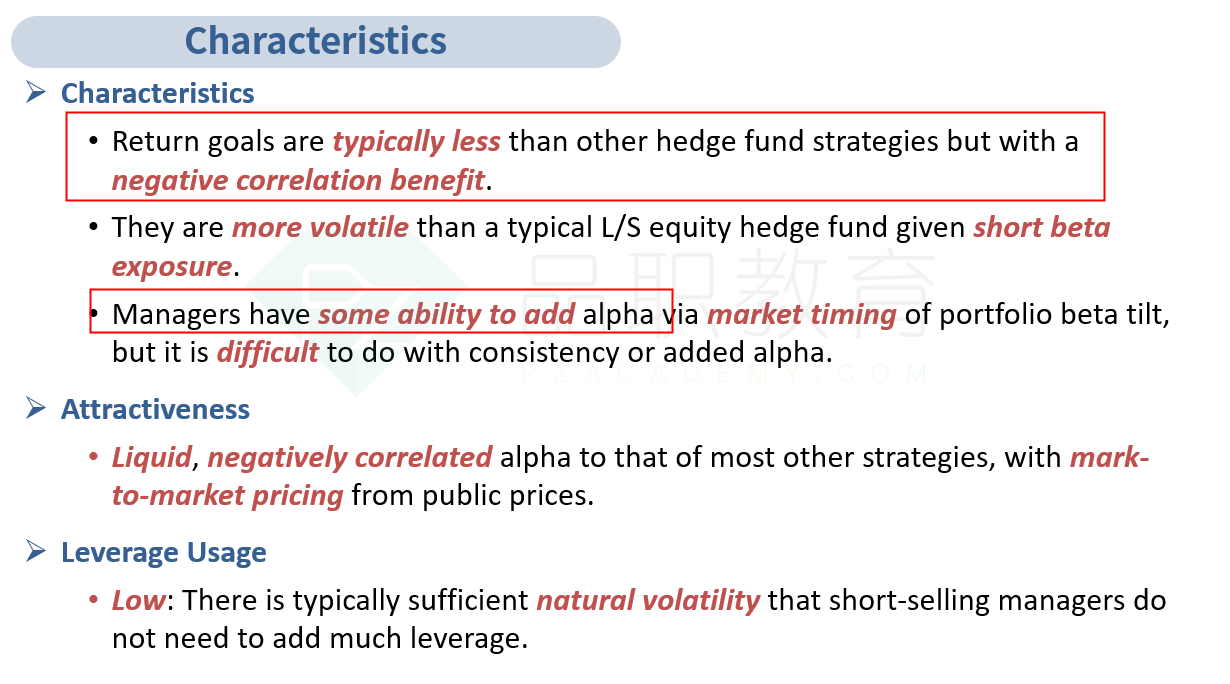

Statement 1: Short-biased equity strategies generally provide alpha when used to diversify public equities.

Statement 2: Short-biased equity strategies are expected to provide a higher reduction in volatility than bonds over a long time horizon.

Statement 3: Short-biased equity strategies are expected to mitigate the risk of public equities by reducing the overall portfolio beta of the fund.

Gension directs

Smittand to prepare asset allocation and portfolio characteristics data on

three alternative portfolios. The fund’s risk profile is one factor that

potential lenders consider when assigning a risk rating to the university. A

loan covenant with the university’s primary lender states that a re-evaluation

of the university’s creditworthiness is triggered if the fund incurs a loss

greater than 20% over any one-year period. Smittand states that the recommended

asset allocation should achieve the following three goals, in order of priority

and importance:

- Minimize the probability of triggering the primary lender’s loan covenant.

- Minimize the probability of purchasing power impairment over a 10-year horizon.

- Maximize the probability of achieving a real return target of 6% over a 10-year horizon.

Notes:

- One-year horizon 99% VaR: the lowest return over any one-year period at a 99% confidence level

- One-year horizon 99% CVaR: the expected return if the return falls below the 99% VaR threshold

- Probability of purchasing power impairment: the probability of losing 40% of the fund’s purchasing power over 10 years, after consideration of new gifts received by the fund, spending from the fund, and total returns

Gension next meets

with the investment committee (IC) of the Opeptaja Pension Plan to discuss new

opportunities in alternative investments. The plan is a $1 billion public

pension fund that is required to provide detailed reports to the public and

operates under specific government guidelines. The plan’s IC adopted a formal

investment policy that specifies an investment horizon of 20 years. The plan

has a team of in-house analysts with significant experience in alternative

investments.

During the

meeting, the IC indicates that it is interested in investing in private real

estate. Gension recommends a real estate investment managed by an experienced

team with a proven track record. The investment will require multiple capital

calls over the next few years. The IC proceeds to commit to the new real estate

investment and seeks advice on liquidity planning related to the future capital

calls.

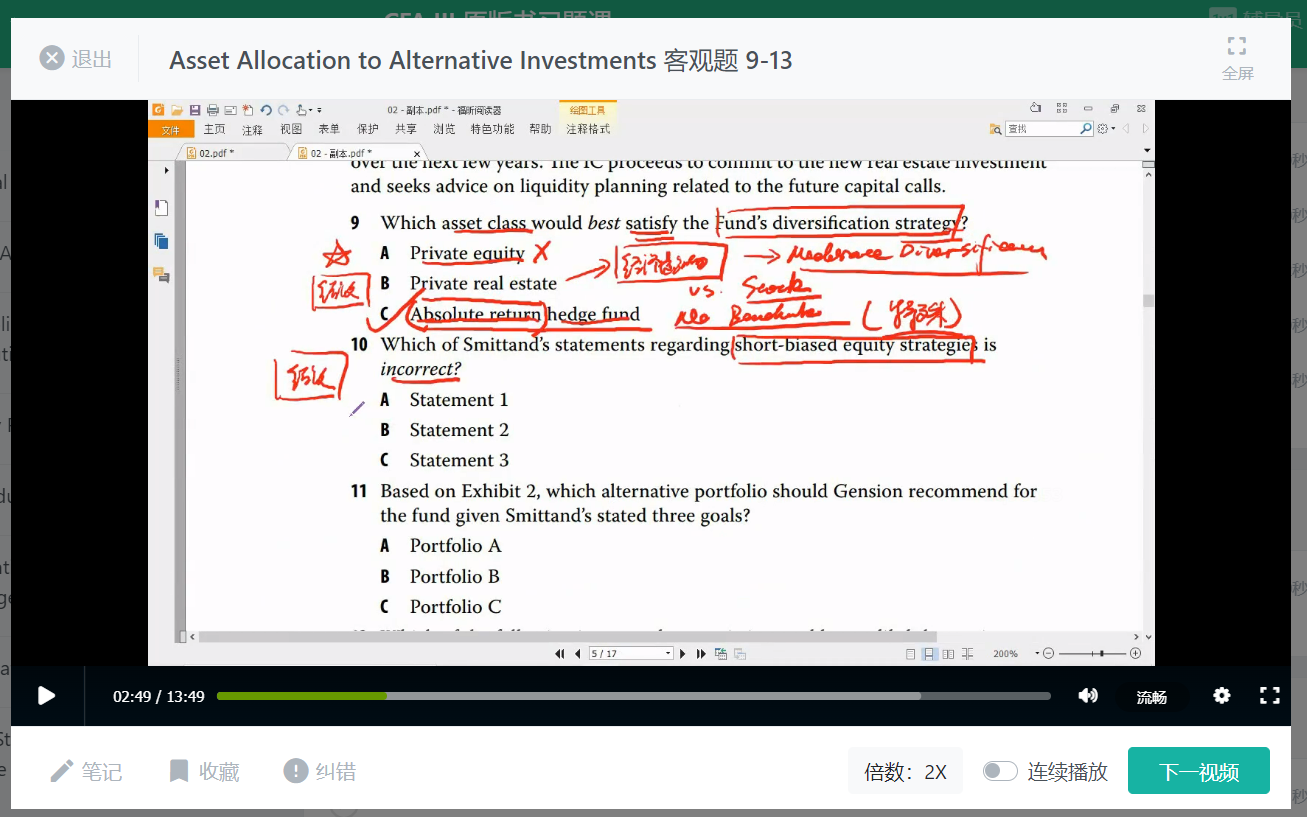

Which of Smittand’s statements regarding short-biased

equity strategies is incorrect?

选项:

A.Statement 1

Statement 2

Statement 3

解释:

B is correct. While bonds reduce the probability of achieving a target return over time, they have been more effective as a volatility mitigator than alternatives over an extended period of time.

A is incorrect because

Statement 1 is correct. Short-biased strategies are expected to provide some

measure of alpha in addition to lowering a portfolio’s overall equity beta.

C is incorrect

because Statement 3 is correct. Short-biased equity strategies help reduce an

equity-dominated portfolio’s overall beta. Short-biased strategies are believed

to deliver equity-like returns with less-than-full exposure to the equity

premium but with an additional source of return that might come from the

manager’s shorting of individual stocks.

B 是正确的。 Short-biased strategies会导致更大的波动因为负的β。

A 不正确,因为陈述 1 是正确的。 除了降低投资组合的整体股票贝塔系数外,Short-biased strategies有望提供一些阿尔法指标。

C 不正确,因为陈述 3 是正确的。 Short-biased strategies有助于降低以股票为主的投资组合的整体贝塔系数。 Short-biased strategies被认为可提供类似股票的回报,但其对股票溢价的敞口只有一部分,但额外的回报来源可能来自经理对个股的卖空。

1.本题没有找到对应的视频讲解

2.Statement 1: Short-biased equity strategies generally provide alpha when used to diversify public equities.

是说 Short-biased equity strategies 用来对上市的权益做分散化,但是同时提供alpha吗?有点不理解,讲义对应的原文在哪里