NO.PZ2023010407000008

问题如下:

Yankel Stein is the chief investment officer of a large charitable

foundation based in the United States. Although the foundation has significant

exposure to alternative investments and hedge funds, Stein proposes to increase

the foundation’s exposure to relative value hedge fund strategies. As part of

Stein’s due diligence on a hedge fund engaging in convertible bond arbitrage,

Stein asks his investment analyst to summarize different risks associated with

the strategy.

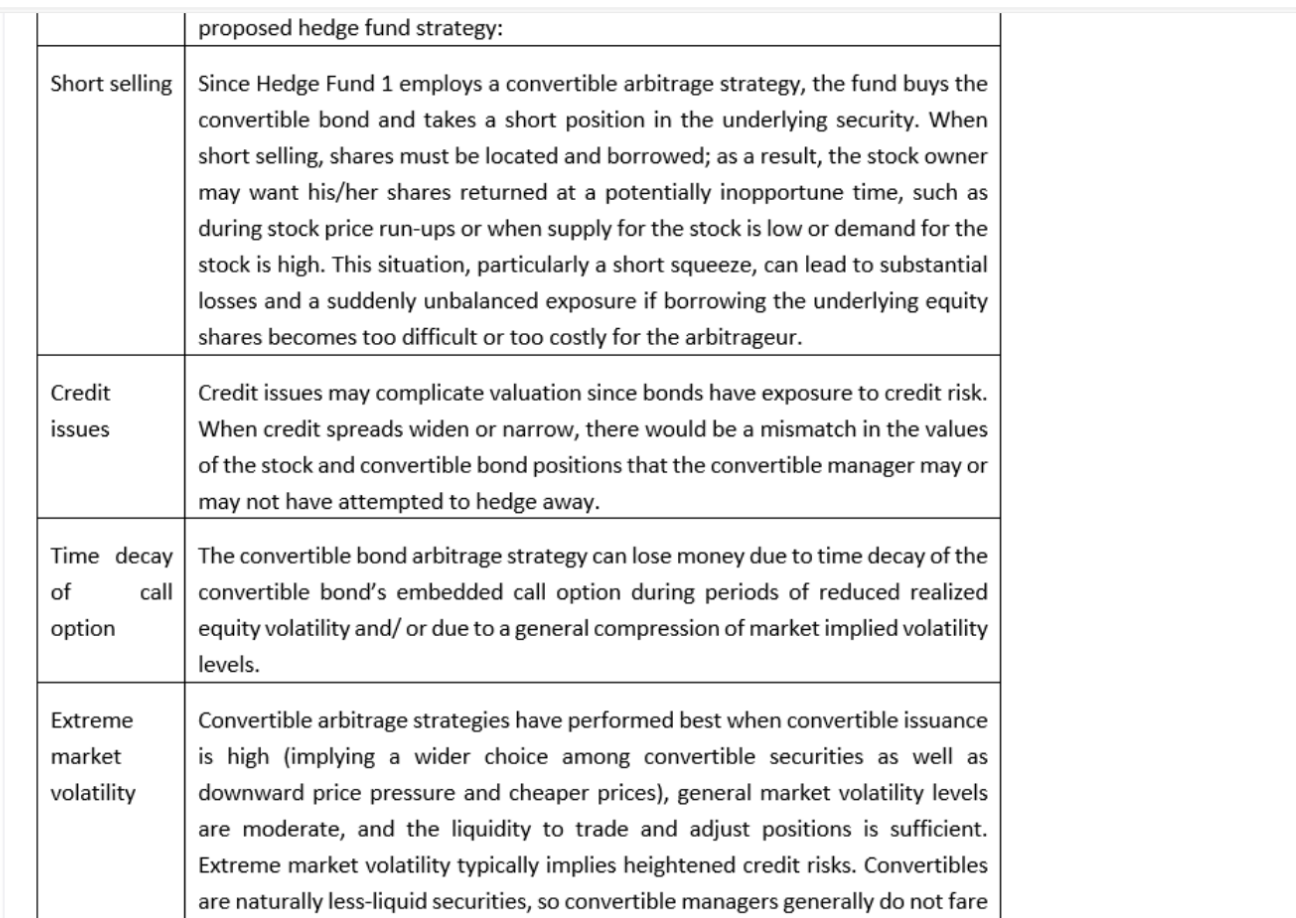

Describe how each of the following

circumstances can create concerns for Stein’s proposed hedge fund strategy: i.

Short selling ii. Credit issues iii. Time decay of call option iv.

Extreme market volatility

选项:

解释:

请问老师这样答可以不