NO.PZ2023112701000048

问题如下:

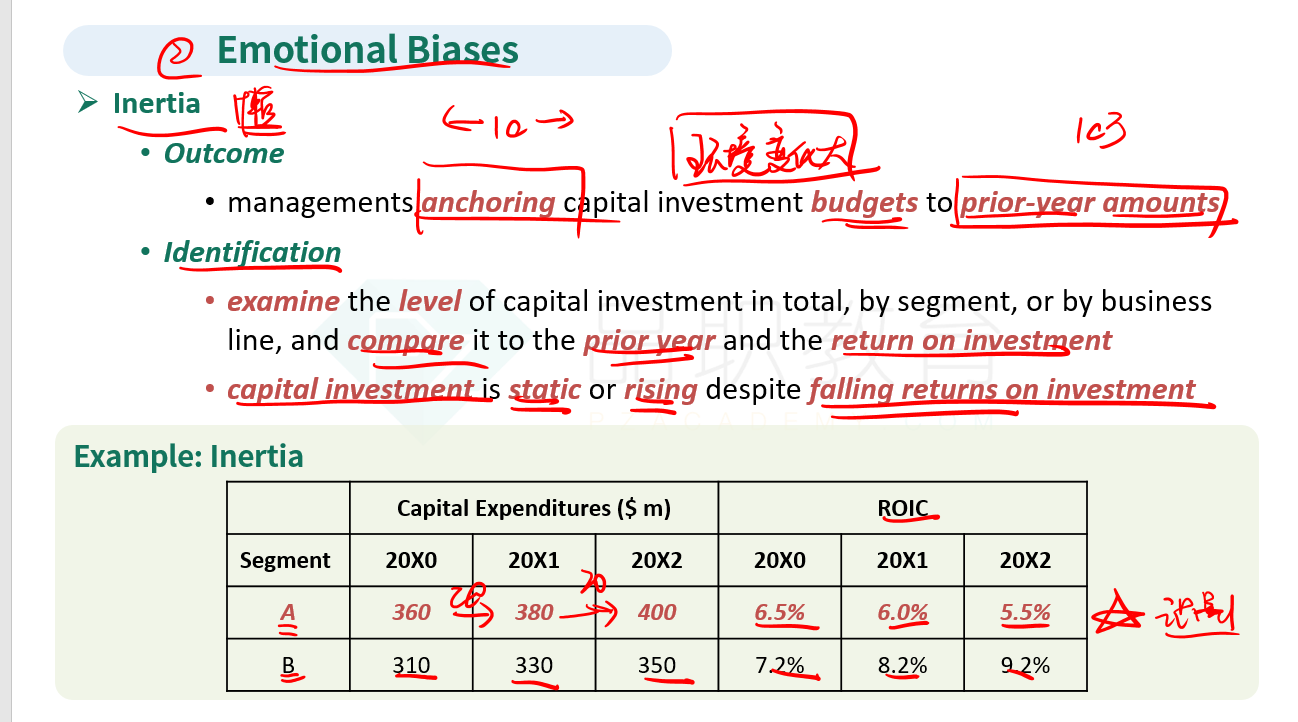

An analyst is analyzing company XYZ and has gathered annual invested capital and ROIC for each of the three XYZ business segments.

Based on the information provided, XYZ’s management is most likely prone to which of the following biases?

选项:

A.Inertia B.Sunk cost C.Pet project解释:

Correct Answer: A

A is correct. Inertia can be identified by examining the level of capital investment in total, by segment, or by business line, if disclosed, and comparing it to the prior year and the return on investment. If capital investment each year is static or rising despite falling returns on investment, the analyst should question the issuer’s justification for a capital investment and whether management should consider alternative uses. In the case of XYZ, we can observe that for segments A and B, ROIC is decreasing, but both segments are getting a higher capital allocation each year.

B is incorrect because sunk cost is related to the capital allocation process in determining a potential project’s profitability. Sunk costs, or those expenses that have already been incurred, should be ignored when evaluating potential projects.

C is incorrect because a detailed view of individual investment projects undertaken by XYZ’s management is not provided. Identifying pet projects from outside the firm is difficult, because financial statements are aggregated and such projects may not meet the threshold of materiality.

老师,不太懂,辛苦讲一下