NO.PZ201709270100000305

问题如下:

Brad Varden, a junior analyst at an actively managed mutual fund, is responsible for research on a subset of the 500 large-cap equities the fund follows. Recently, the fund has been paying close attention to management turnover and to publicly available environmental, social, and governance (ESG) ratings. Varden is given the task of investigating whether any significant relationship exists between a company’s profitability and either of these two characteristics. Colleen Quinni, a

senior analyst at the fund, suggests that as an initial step in his investigation,

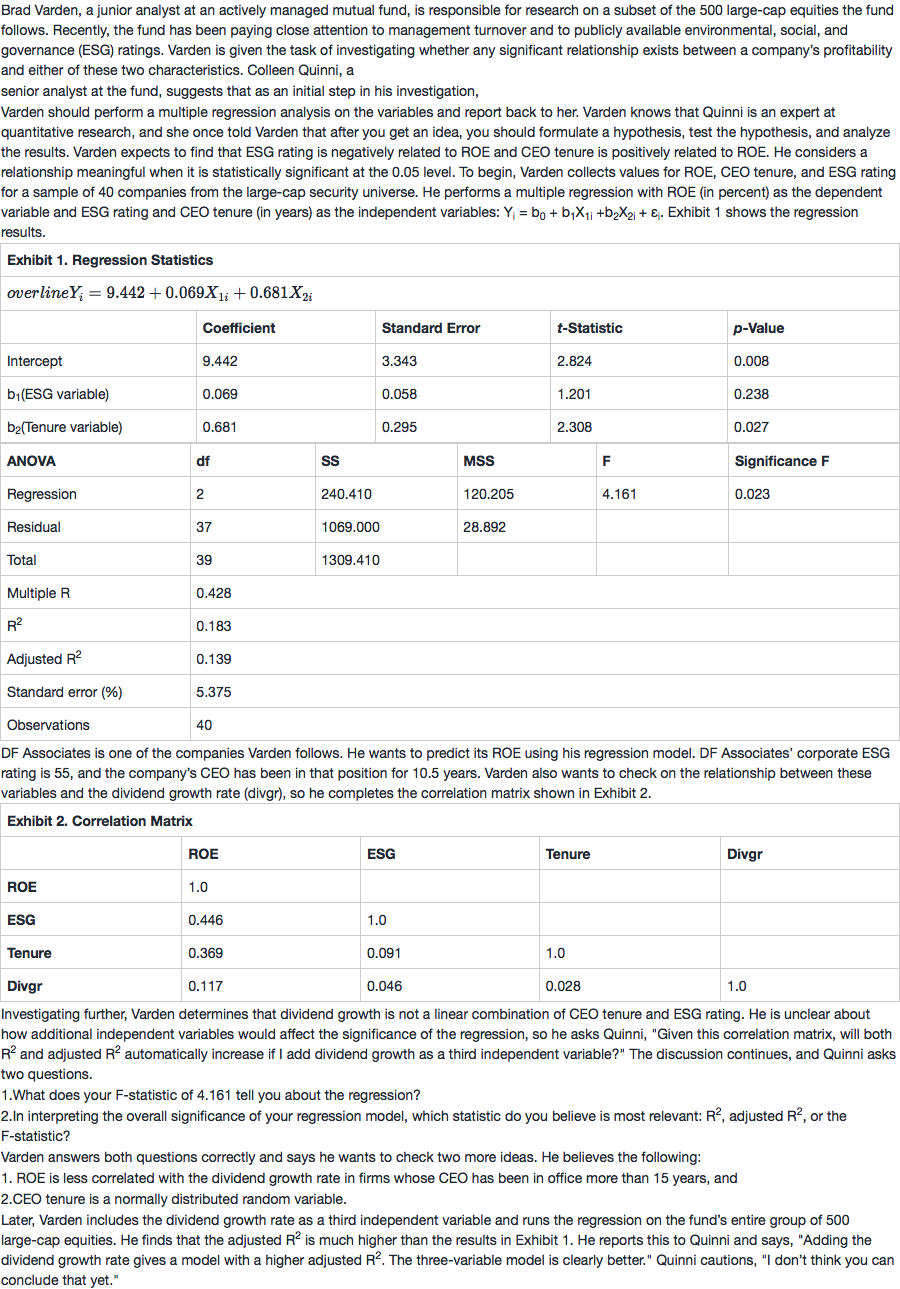

Varden should perform a multiple regression analysis on the variables and report back to her. Varden knows that Quinni is an expert at quantitative research, and she once told Varden that after you get an idea, you should formulate a hypothesis, test the hypothesis, and analyze the results. Varden expects to find that ESG rating is negatively related to ROE and CEO tenure is positively related to ROE. He considers a relationship meaningful when it is statistically significant at the 0.05 level. To begin, Varden collects values for ROE, CEO tenure, and ESG rating for a sample of 40 companies from the large-cap security universe. He performs a multiple regression with ROE (in percent) as the dependent variable and ESG rating and CEO tenure (in years) as the independent variables: Yi = b0 + b1X1i +b2X2i + εi. Exhibit 1 shows the regression results.

DF Associates is one of the companies Varden follows. He wants to predict its ROE using his regression model. DF Associates’ corporate ESG rating is 55, and the company’s CEO has been in that position for 10.5 years. Varden also wants to check on the relationship between these variables and the dividend growth rate (divgr), so he completes the correlation matrix shown in Exhibit 2.

Investigating further, Varden determines that dividend growth is not a linear combination of CEO tenure and ESG rating. He is unclear about how additional independent variables would affect the significance of the regression, so he asks Quinni, "Given this correlation matrix, will both R2 and adjusted R2 automatically increase if I add dividend growth as a third independent variable?" The discussion continues, and Quinni asks two questions.

1.What does your F-statistic of 4.161 tell you about the regression?

2.In interpreting the overall significance of your regression model, which statistic do you believe is most relevant: R2, adjusted R2, or the F-statistic?

Varden answers both questions correctly and says he wants to check two more ideas. He believes the following:

1. ROE is less correlated with the dividend growth rate in firms whose CEO has been in office more than 15 years, and

2.CEO tenure is a normally distributed random variable.

Later, Varden includes the dividend growth rate as a third independent variable and runs the regression on the fund’s entire group of 500 large-cap equities. He finds that the adjusted R2 is much higher than the results in Exhibit 1. He reports this to Quinni and says, "Adding the dividend growth rate gives a model with a higher adjusted R2. The three-variable model is clearly better." Quinni cautions, "I don’t think you can conclude that yet."

5. Based on Exhibit 2, Quinni’s best answer to Varden’s question about the effect of adding a third independent variable is:

选项:

A.no for R2 and no for adjusted R2.

B.yes for R2 and no for adjusted R2.

C.yes for R2 and yes for adjusted R2.

解释:

B is correct. When you add an additional independent variable to the regression model, the amount of unexplained variance will decrease, provided the new variable explains any of the previously unexplained variation. This result occurs as long as the new variable is even slightly correlated with the dependent variable. Exhibit 2 indicates the dividend growth rate is correlated with the dependent variable, ROE. Therefore, R2 will increase.

Adjusted R2, however, may not increase and may even decrease if the relationship is weak. This result occurs because in the formula for adjusted R2, the new variable increases k (the number of independent variables) in the denominator, and the increase in R2 may be insufficient to increase the value of the formula.

老师 麻烦解释一下这题,为什么选B呀,为什么R^2是yes