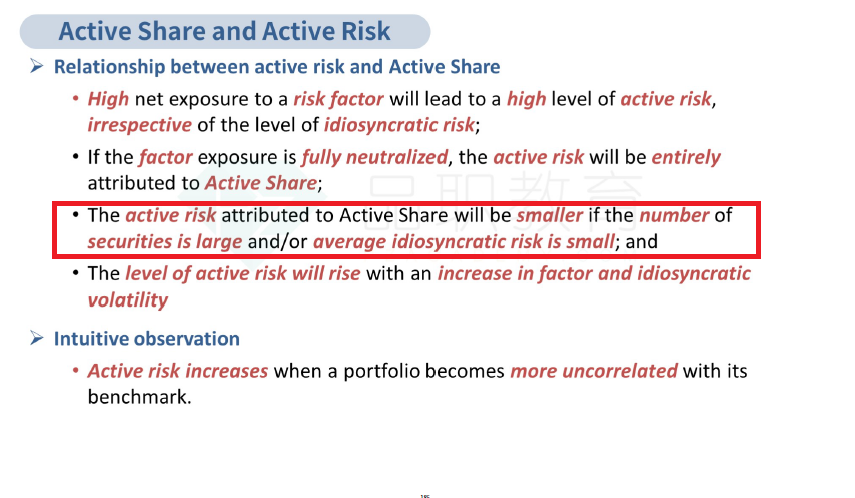

The Mattley Fund exhibited relatively high Active Share but relatively low active risk. High Active Share indicates that a manager’s holdings differ substantially from the benchmark, and low active risk indicates low idiosyncratic risk resulting from diversification: This combination indicates that the manager most likely follows a diversified stock picking strategy. A sector rotator typically has high active risk and could have either high or low Active Share, depending on whether a concentrated or diversified portfolio approach was followed. A closet index would exhibit both low Active Share and low active risk, because such funds make few active bets.

老师,标红的这句话,我认为解释的是不是有问题,low idiosyncratic risk resulting from diversification应该降低的是portfolio risk吧,不应该降低active risk, active risk不是偏离benchmark来衡量吗?