Choate does not limit his investments strictly to domestic issuers. He prefers to traverse the global waters for opportunities. His rationale is fairly straightforward: “The credit market is global in nature. We evaluate opportunities across regions and countries, which include emerging markets. We are especially keen on emerging market credits, which can provide excess returns that outperform the domestic and global developed market indexes. Because the emerging market credits are not included in the performance benchmark, we limit the maximum exposure to this asset class and buy them in either USD or the local currency depending on the total expected return of the transaction.”

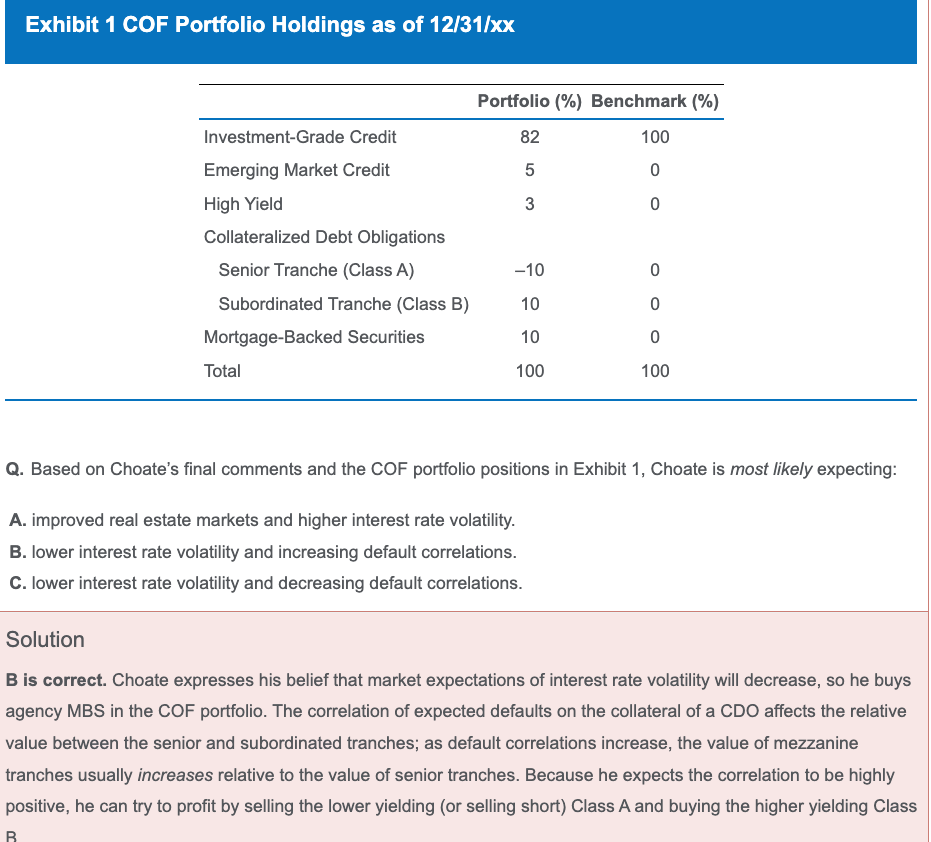

Choate’s final comments to Hale detail how he also looks for structured financial instruments that offer diversification benefits and attractive expected returns. These are listed in Exhibit 1, which shows recent COF portfolio positioning relative to the benchmark and reflects various opportunities Choate has uncovered across several markets.

不明白