NO.PZ2023081403000100

问题如下:

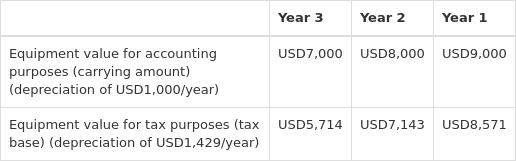

Q. Please use the selected data in Exhibit 1 for the Samuels Corporation.

Exhibit 1:

Selected Data for Samuels Company (US dollar millions)

Assuming a 35 percent tax rate and the selected data below for the Samuels Company, the company’s deferred tax liability in Year 3 is closest to:

选项:

A.USD450.

B.USD750.

C.USD900.

解释:

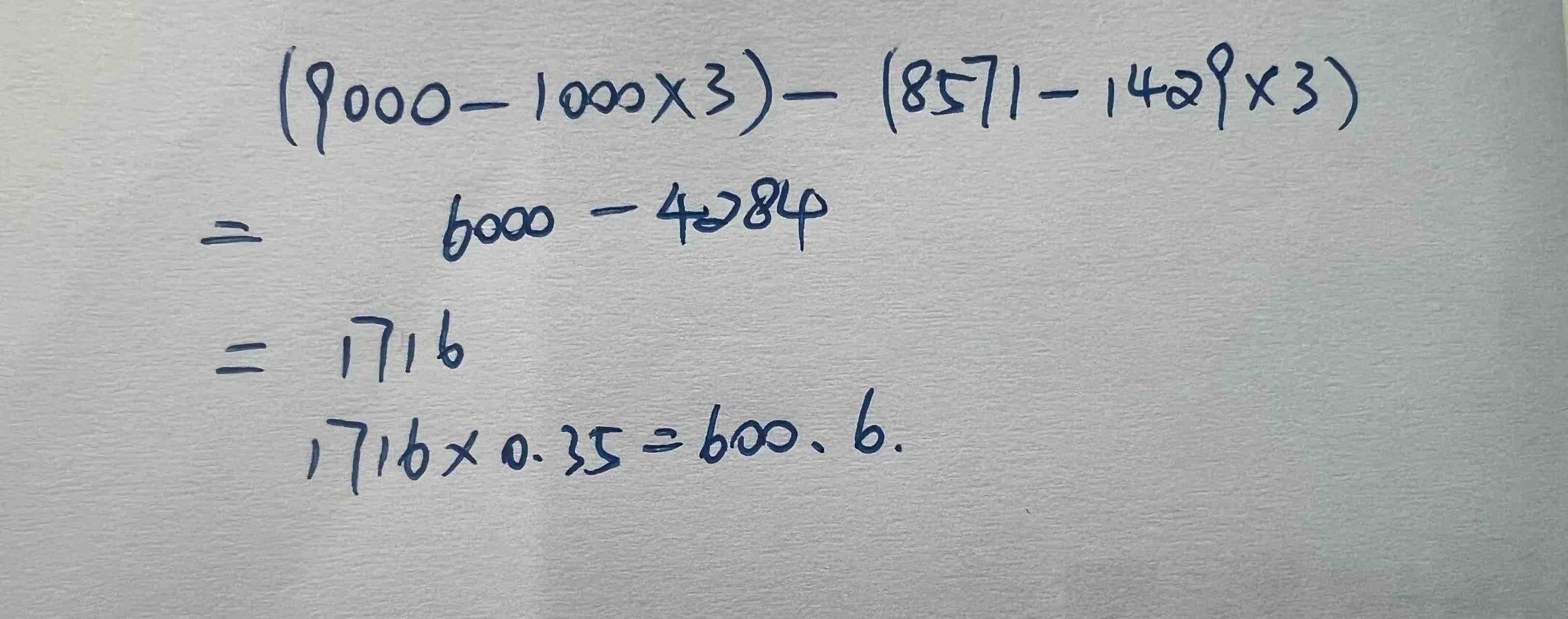

A is correct. USD450 is calculated as: (USD7,000 − USD5,714) × 0.35 = USD450. B is incorrect because it incorrectly sums the deferred tax liabilities from Years 2 and 3: (USD7,000 − USD5,714) × 0.35 + (USD8,000 − USD7,143) × 0.35 = USD750. C is incorrect because it incorrectly sums the deferred tax liabilities from Years 1, 2 and 3: (USD7,000 − USD5,714) × 0.35 + (USD8,000 − USD7,143) × 0.35 + (USD9,000 − USD8,571) × 0.35 = USD900.

请老师看看我的理解错在哪里了