NO.PZ2023010903000029

问题如下:

The Cherry Street Foundation is a nonprofit institution that provides resources for refugee children around the world. Over the last several years, Cherry Street has experienced a significant increase in donations, resulting in an increase to the foundation's investment portfolio of more than $100 million. Consequently, Ellie Blumenstock, CFA, Cherry Street's founder, recently concluded that the time had come to hire a professional chief investment officer(CIO) to manage this large pool of assets. Today, Blumenstock is interviewing A.J. Gelormini,a portfolio manager with over two decades of experience, for the CIO role.

At the start of the interview, Blumenstock asks Gelormini to explain his approach to investing in global equities. Gelormini's response includes the following statements:

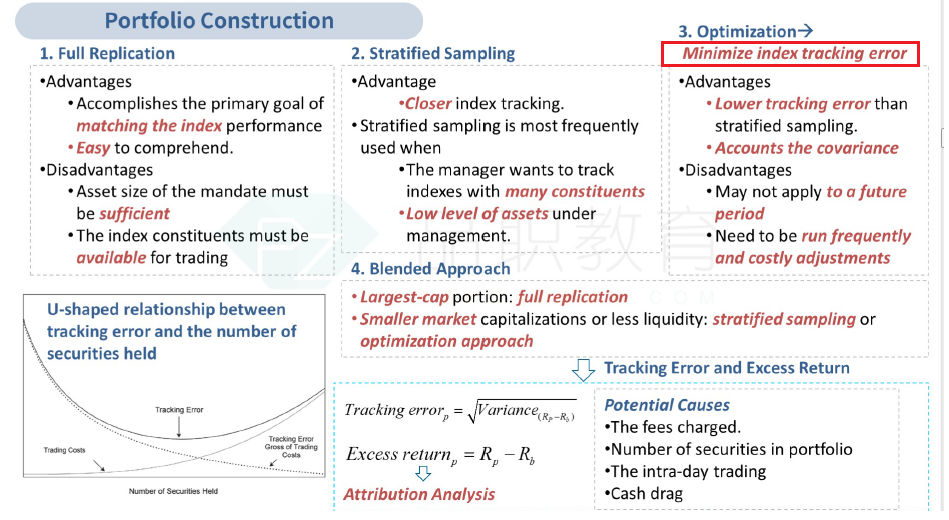

Statement 2: I would build passively managed funds internally through direct investment in individual securities. My focus would be on constructing funds that minimize tracking error versus the benchmark, subject to a constraint that each fund's volatility equals that of its relevant benchmark. Cherry Street would have several such funds, all under $5 million in assets, with benchmarks containing over 2,000 constituents.

Given Gelormini's comments in Statement 2, the best approach he could take to construct passive portfolios for Cherry Street is:

选项:

A.full replication

stratified sampling

optimization

解释:

Optimization typically involves maximizing a desirable element or minimizing an undesirable characteristic, subject to one or more constraints. In this case, Gelormini has stated that he would build portfolios that would minimize tracking error, subject to a constraint on portfolio volatility.

full replication 不就可以最小化tracking error了?