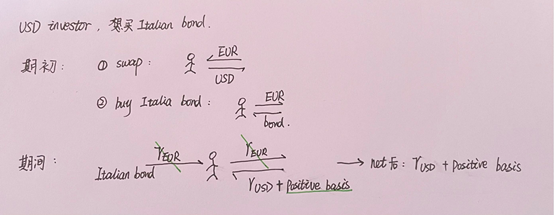

Continuing from the previous question, assume demand for US dollars is strong relative to demand for euros, so there is a positive basis for “lending” US dollars. By hedging the position in Italian government bonds with the currency basis swap, the US investor will most likely increase the periodic net interest payments received from the swap counterparty in:

- euros only.

- US dollars only.

- both euros and US dollars.

不是说这个basis一般是在非美元端,那就是在swap交换期间欧元的浮动利率可能减少,比如减少15bp,那这样不是欧元的period interest payment也有增加么。(从投资意大利债券里收到欧元利率,然后swap里支出欧元利率 — 15bp)