NO.PZ2023081403000042

问题如下:

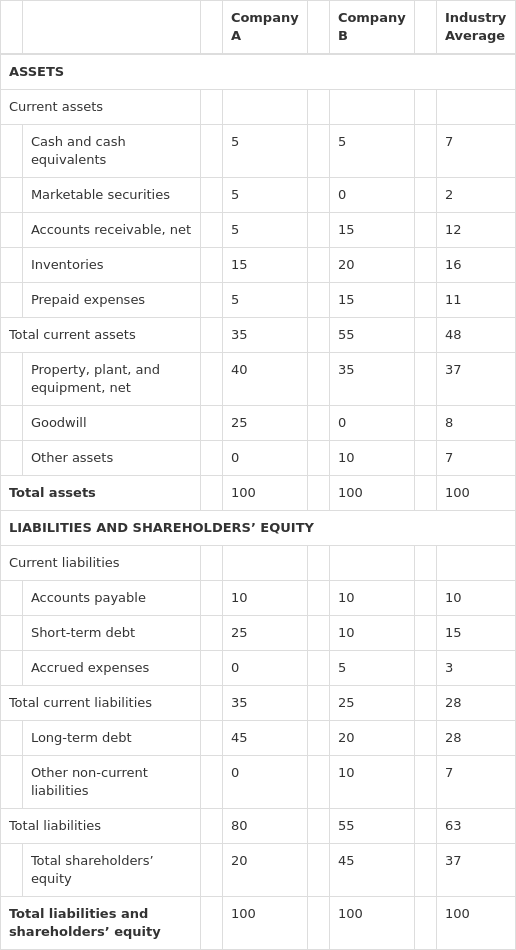

Q. Consider the common-size balance sheets in Exhibit 1 for Company A, Company B, as well as the industry average. Which statement is correct?

Exhibit 1:

Balance Sheet and Industry Average

选项:

A.Company A has below-average liquidity risk.

B.Company B has above-average solvency risk.

C.Company A has made one or more acquisitions.

解释:

C is correct. The presence of goodwill on Company A’s balance sheet signifies that it has made one or more acquisitions in the past. The current, cash, and quick ratios are lower for Company A than for the sector average. These lower liquidity ratios imply above-average liquidity risk. The total debt, long-term debt-to-equity, debt-to-equity, and financial leverage ratios are lower for Company B than for the sector average. These lower solvency ratios imply below-average solvency risk.

Current ratio is (35 ÷ 35) = 1.00 for Company A, versus (48 ÷ 28) = 1.71 for the sector average.Cash ratio is (5 + 5) ÷35 = 0.29 for Company A, versus (7 + 2) ÷28 = 0.32 for the sector average.Quick ratio is (5 + 5 + 5) ÷35 = 0.43 for Company A, versus (7 + 2 + 12) ÷28 = 0.75 for the sector average.Total debt ratio is (55 ÷ 100) = 0.55 for Company B, versus (63 ÷ 100) = 0.63 for the sector average.Long-term debt-to-equity ratio is (20 ÷ 45) = 0.44 for Company B, versus (28 ÷ 37) = 0.76 for the sector average.Debt-to-equity ratio is (55 ÷ 45) = 1.22 for Company B, versus (63 ÷ 37) = 1.70 for the sector average.Financial leverage ratio is (100 ÷ 45) = 2.22 for Company B, versus (100 ÷ 37) = 2.70 for the sector average.这道题明确将Short term debt与Long term debt区分开来写了,为什么答案里面用了TL算leverage,我应该用STD ➕LTD是不是更好