NO.PZ2023112401000010

问题如下:

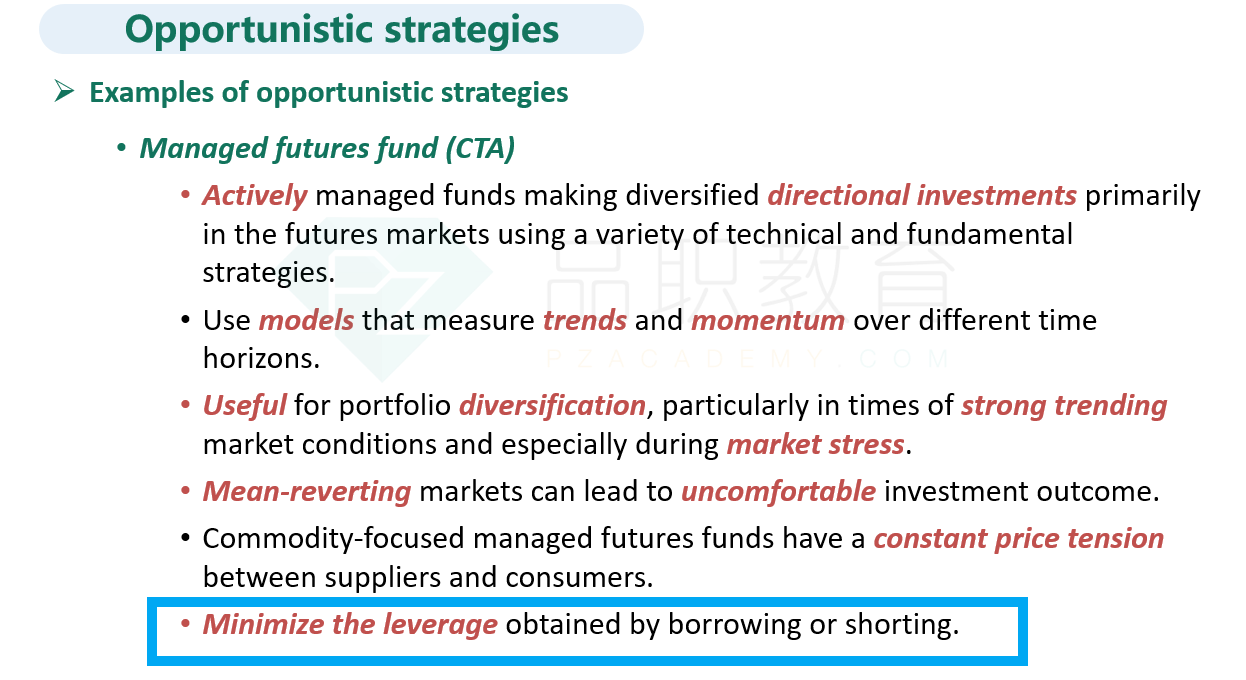

An investor wants to invest in a diversified hedge fund that minimizes the return correlation with the traditional asset classes but would prefer the fund to be more liquid and transparent while minimizing the leverage obtained by borrowing or shorting. What would be the most appropriate hedge fund the investor can choose?

选项:

A.

Fundamental value

B.

Managed futures

C.

Multi-strategy

D.

Fund of funds

解释:

B is correct. Managed futures have, historically, exhibited low correlation with traditional assets and invest in active futures in liquid commodities and foreign exchange markets. They are also able to increase exposure without resorting to borrowing or shorting.

为什么d不对呀?题目里would prefer the fund to be more liquid and transparent,感觉是FOF的特性呀?