NO.PZ201909280100001102

问题如下:

Which of Smittand’s statements regarding short-biased

equity strategies is incorrect?

选项:

A.

Statement 1

B.

Statement 2

C.

Statement 3

解释:

B is correct. While bonds reduce the probability of achieving a target return over time, they have been more effective as a volatility mitigator than alternatives over an extended period of time.

A is incorrect because

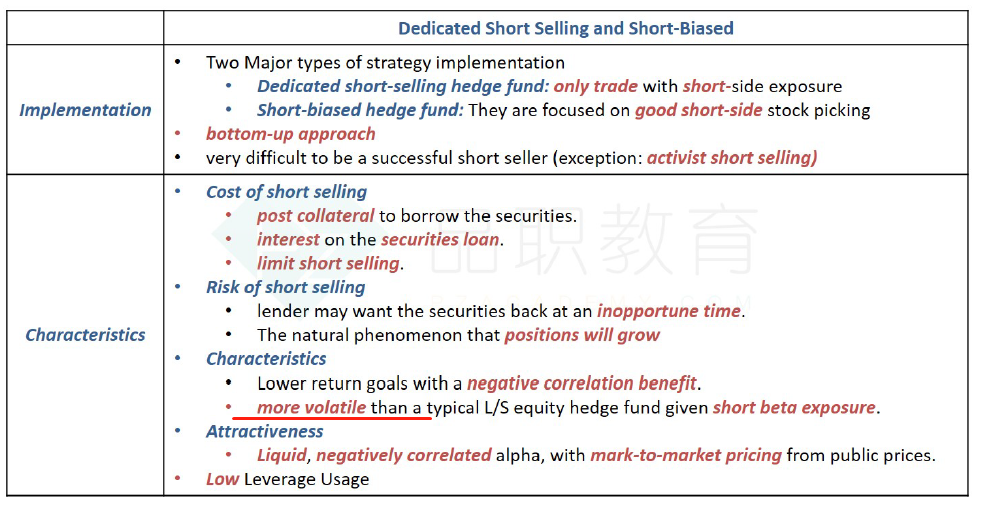

Statement 1 is correct. Short-biased strategies are expected to provide some

measure of alpha in addition to lowering a portfolio’s overall equity beta.

C is incorrect

because Statement 3 is correct. Short-biased equity strategies help reduce an

equity-dominated portfolio’s overall beta. Short-biased strategies are believed

to deliver equity-like returns with less-than-full exposure to the equity

premium but with an additional source of return that might come from the

manager’s shorting of individual stocks.

B 是正确的。 Short-biased strategies会导致更大的波动因为负的β。

A 不正确,因为陈述 1 是正确的。 除了降低投资组合的整体股票贝塔系数外,Short-biased strategies有望提供一些阿尔法指标。

C 不正确,因为陈述 3 是正确的。 Short-biased strategies有助于降低以股票为主的投资组合的整体贝塔系数。 Short-biased strategies被认为可提供类似股票的回报,但其对股票溢价的敞口只有一部分,但额外的回报来源可能来自经理对个股的卖空。

如上所述,请老师解答,谢谢