NO.PZ2023112701000047

问题如下:

Which of the following statements concerning cash-flow forecasts for projects is most likely correct?

选项:

A.include the cost of market research that was recently completed. B.ignore potential loss of revenue from existing products that could occur if project is undertaken. C.if delay all future cash flows by six months, the result would be a lower IRR and a lower NPV.解释:

Correct Answer: C

C is correct. The forecasted timing of cash flow is an important factor affecting both projects’ IRR and NPV. In the case of delaying all future cash flows from both projects by six months, the result would be a lower IRR and a lower NPV. Given that all future cash flows are to be received six months later, their present value decreases; hence, the NPV and IRR of an entire project also decrease.

A is incorrect. The market research costs in this case are a sunk cost because the research has already been completed and therefore does not affect cash-flow estimates.

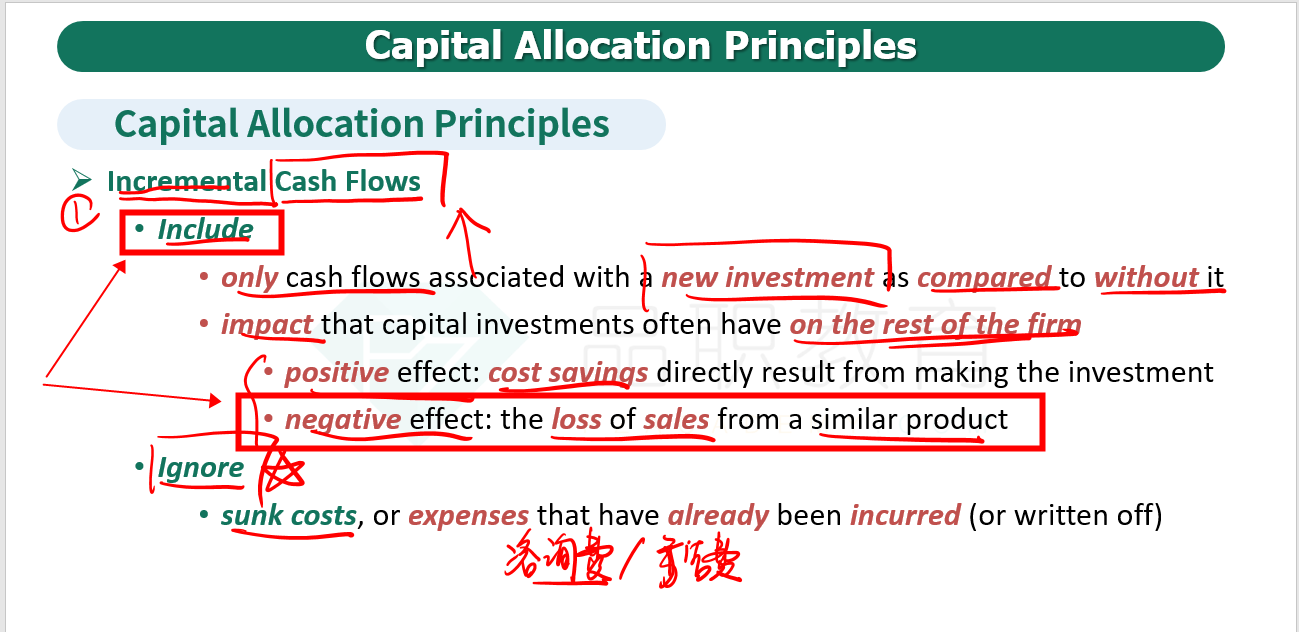

B is incorrect. Capital allocation analysis should include only incremental cash flows associated with a new investment. The loss of revenue from existing products is an incremental negative effect that should be included in the analysis.

b能解释一下吗,没太明白为什么