NO.PZ2018111501000006

问题如下:

The portfolio performance is measure in USD. According to the exchange rate data below, which domestic-currency return over the last six months was lower than the foreign-currency return? (Rfc >-1 ,Rdc >-1)

选项:

A.

EUR-denominated assets

B.

GBP-denominated assets

C.

JPY- denominated assets

解释:

C is correct.

考点:Currency Risk & Portfolio Return and Risk

解析:

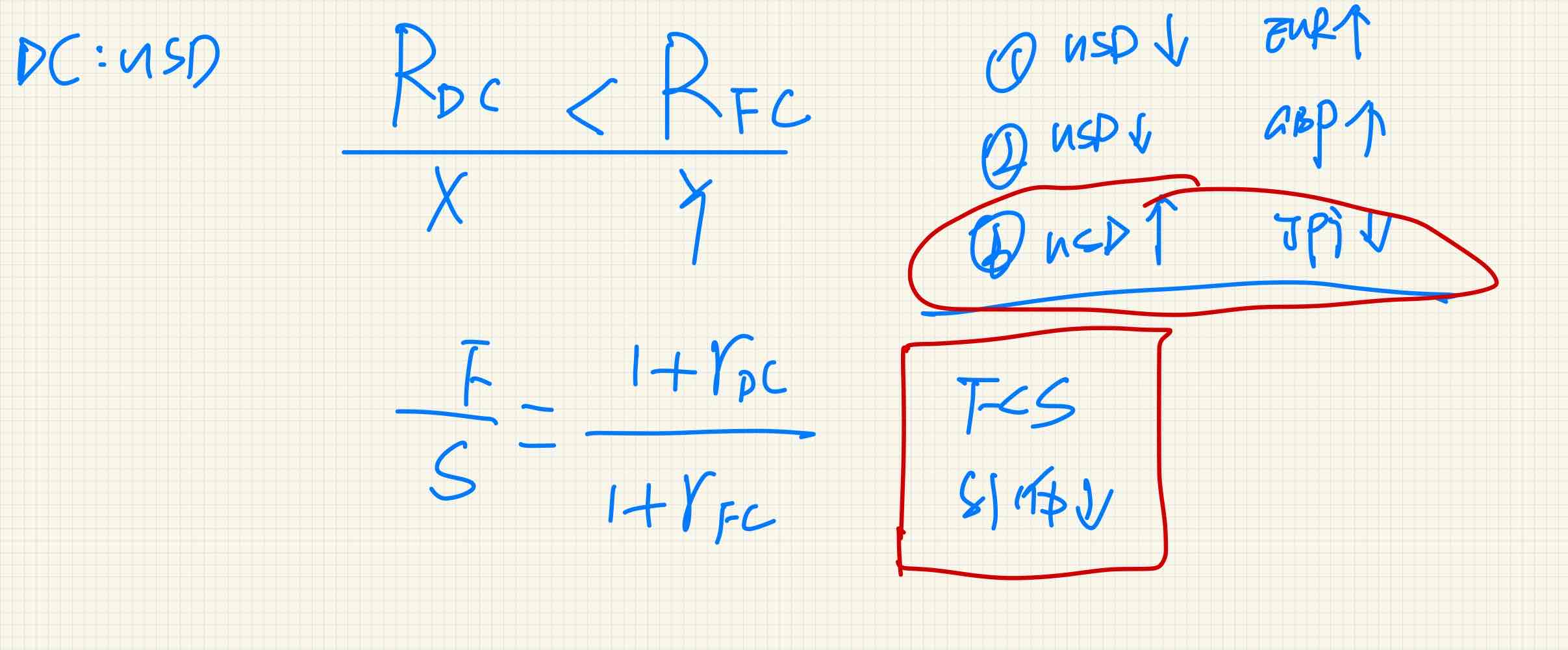

本题中根据第一句话可知是以USD来衡量业绩的,即本币是USD。外币敞口为EUR,GBP和JPY。

题干要求找到的外币资产,根据公式,要找的就是的资产。如果给出DC/FC的外汇报价方式,那么需要找的就是FC贬值,也就是外汇报价减小的资产。然而题中给的是FC/DC的外汇报价(注意:美元是本币),因此我们要找的是这种报价方式下,外汇报价增加的资产。六个月前JPY/USD报价113.42,现在114.75,是增加的,所以选C。

这道题可以这样分析吗?是否有问题?是否有假设条件的不成立?